Industry Overview

The Global Smart Sensor Market witnessed a significant growth trajectory, with a valuation of USD 37.1 billion in 2023. Projections indicate that it will further expand and reach USD 92.3 billion by 2030, exhibiting an impressive compound annual growth rate (CAGR) of 19.4% from 2025 to 2030.

Smart sensor is a pivotal technological development that provides control and monitoring of various operations. The ever-increasing demand for efficiency and performance has driven the popularity of smart sensors. Factors driving the growth of the smart sensor market include rising implementation of the smart sensor in different manufacturing industries, rising demand in electronics, development of smart cities, mounting demand by automobile manufacturers to provide safe and easy products and to ensure low power consumption. Moreover, the emergence of IoT, automation in automobiles, wearable devices, are the other factors that drive the growth of the smart sensor market.

The COVID-19 pandemic has resulted in a decline in the growth of the smart sensor market as there is a temporary shutdown of manufacturing and production industries. However, the market will recover due to the mounting demand for smart technologies in IoT-based infrastructure like smart grids and smart cities globally.

Smart Sensor Market Segmentation

Insight by Type

Based on type, the global smart sensor market is segmented into pressure sensors, temperature & humidity sensors, flow sensors, image sensors, touch sensors, water sensors, motion & occupancy sensors, position sensors, light sensors, ultrasonic sensors, and others. The temperature & humidity sensor is anticipated to have high CAGR during the forecast period owing to its wide acceptance in measurement control systems and instrumentation. They are used to interpret temperature reading in a digital format, resulting in its ease of use in different applications such as healthcare, automotive, etc. The image sensors dominate the market in 2020 owing to their use in the industrial market. The light sensor is anticipated to have high CAGR due to the mounting demand for smart lights and smartwatches worldwide.

Insight by Component

Based on component, the global smart sensor market is segmented into transceivers, amplifiers, analog to digital converters, digital to analog converters, and microcontrollers. There is wide use of the components in the consumer electronics sector that will drive the growth of the global smart sensor.

Insight by Technology

Based on technology, the global smart sensor market is categorized into CMOS, MEMS, and others. Among these categories, MEMS technology is anticipated to have a significant CAGR during the forecast period owing to the government regulations about driving, rising concern about passenger safety, used in airbag systems, surging adoption of wearable technology such as smartwatches, and the rising adoption of IoT.

Insight by Connectivity

Based on connectivity, the global smart sensor market is bifurcated into wired network connectivity and wireless network connectivity. The wireless network connectivity is expected to register high CAGR during the forecast period owing to the rising adoption of wireless networks in commercial spaces, high speed along with cost efficiency with no need for infrastructure.

Insight by End-Use Industry

Based on the end-use industry, the global smart sensor market is divided into the biomedical & healthcare industry, automotive industry, aerospace & defense industry, building automation industry, consumer electronics industry, industrial automation industry, and others. The automotive industry dominates the smart sensor market owing to the rising demand for vehicles, driver security features, the introduction of innovative and developed features by industry players. Moreover, consumer electronics have a high CAGR during the forecast period owing to the rising penetration of smartphones in emerging economies globally, rising adoption of digital SLR cameras, mirrorless cameras, and the emergence of drone cameras, thus fueling the growth of the smart sensor market.

Global Smart Sensor Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 37.1 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 92.3 Billion

|

|

Growth Rate

|

19.4%

|

|

Segments Covered in the Report

|

By Type, By Component, By Technology, By Connectivity and By End-Use Industry

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Smart Sensor Industry Trends

The COVID-19 pandemic has led to the adoption of Industry 4.0 wherein many enterprises in industries are adopting innovative IoT technology and influence production, marketing, and maintenance. Moreover, favorable government regulations and FDI inflows will propel the market growth in the smart sensor market.

Smart Sensor Market Growth Drivers

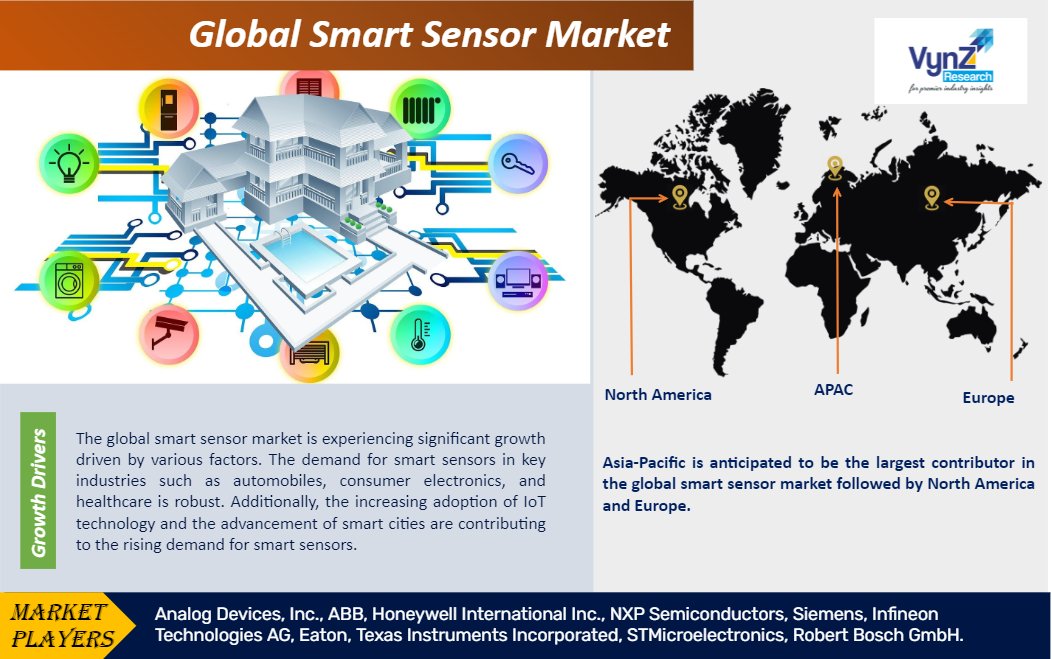

The global smart sensor market is experiencing significant growth driven by various factors. The demand for smart sensors in key industries such as automobiles, consumer electronics, and healthcare is robust. Additionally, the increasing adoption of IoT technology and the advancement of smart cities are contributing to the rising demand for smart sensors.

The market growth is further fueled by the increasing popularity of autonomous products and the need for energy-efficient and cost-saving devices. Technological advancements in miniaturization and wireless capabilities are also playing a crucial role in driving the market forward. Moreover, favorable government initiatives are supporting the expansion of the smart sensor market.

Smart devices offer innovation, high efficiency, and innovative features, making them appealing to a broader audience. As a result, the market for smart sensors is expected to grow steadily, benefiting from the increasing adoption and popularity of these devices.

Smart Sensor Market Challenges

The high deployment cost associated with technology, complex design as compared to traditional sensors, and reduces life of devices when installed in smart sensors may hamper the growth of the smart sensor market.

Smart Sensor Market Opportunities

The adoption of smart wearable devices, smart homes, smart cities, and innovative applications in the biomedical sector will create promising growth opportunities in the global smart sensor market. Smart homes and smart cities are the rising trends that will create opportunities for growth in the market size of the smart sensor market.

Smart Sensor Market Geographic Overview

Asia-Pacific is anticipated to be the largest contributor in the global smart sensor market followed by North America and Europe. Asia-Pacific dominates the market owing to the strong development in China, India, and Japan, increasing consumer preference for energy conservation and wireless technology, self-diagnosis, self-calibration capabilities, expansion in various end-use verticals such as automotive, consumer electronics, and healthcare, results in growth in the region. Moreover, increasing technological development, initiatives by the government by focusing on infrastructure development will fuel the growth in the region.

Smart Sensor Market Competitive Insight

The smart sensor market is highly competitive and strategies followed by the industry players include product innovation, mergers and acquisitions, collaborations, partnerships, and technological developments to have a competitive edge among competitors.

Infineon Technologies AG, Elliptic Labs, a global AI software company and world leader in virtual smart sensors, has announced a partnership. This collaboration adds new capabilities such as breathing and heartbeat detection to Elliptic Labs' existing presence and gesture detection capabilities.

Honeywell came into partnership with Signify, the world leader in lighting. The partnership aims to deploy integrated, smart lighting solutions for commercial buildings. The purpose of the partnership is to enhance the occupant experience aiming at productivity and well-being and to decrease the consumption of energy.

Some of the key players operating in the smart sensor market: Analog Devices, Inc., ABB, Honeywell International Inc., NXP Semiconductors, Siemens, Infineon Technologies AG, Eaton, Texas Instruments Incorporated, STMicroelectronics, Robert Bosch GmbH.

The Global Smart Sensor Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Type

- Pressure Sensors

- Temperature & Humidity Sensors

- Flow Sensors

- Image Sensors

- Touch Sensors

- Water Sensors

- Motion & Occupancy Sensors

- Position Sensors

- Light Sensors

- Ultrasonic Sensors

- Others

- By Component

- Transceivers

- Amplifiers

- Analog to Digital Converters

- Digital to Analog Converters

- Microcontrollers

- By Technology

- By Connectivity

- Wired Network Connectivity

- Wireless Network Connectivity

- By End-Use Industry

- Biomedical & Healthcare Industry

- Automotive Industry

- Aerospace & Defense Industry

- Building Automation Industry

- Consumer Electronics Industry

- Industrial Automation Industry

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source:VynZ Research

.png)