| Status : Published | Published On : Dec, 2023 | Report Code : VRSME9148 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 220 |

Global Solid-State Battery Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (thin-film batteries, portable batteries, and other), by Category (single-cell battery and multi-cell battery), by Capacity (20 mAh, between 20 mAh-500 mAh, and above 500 mAh), by Application (consumer electronics, electric vehicle, energy harvesting, entertainment, medical devices, packaging, portable devices, smart cards, wearable devices, wireless communication, and other applications), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

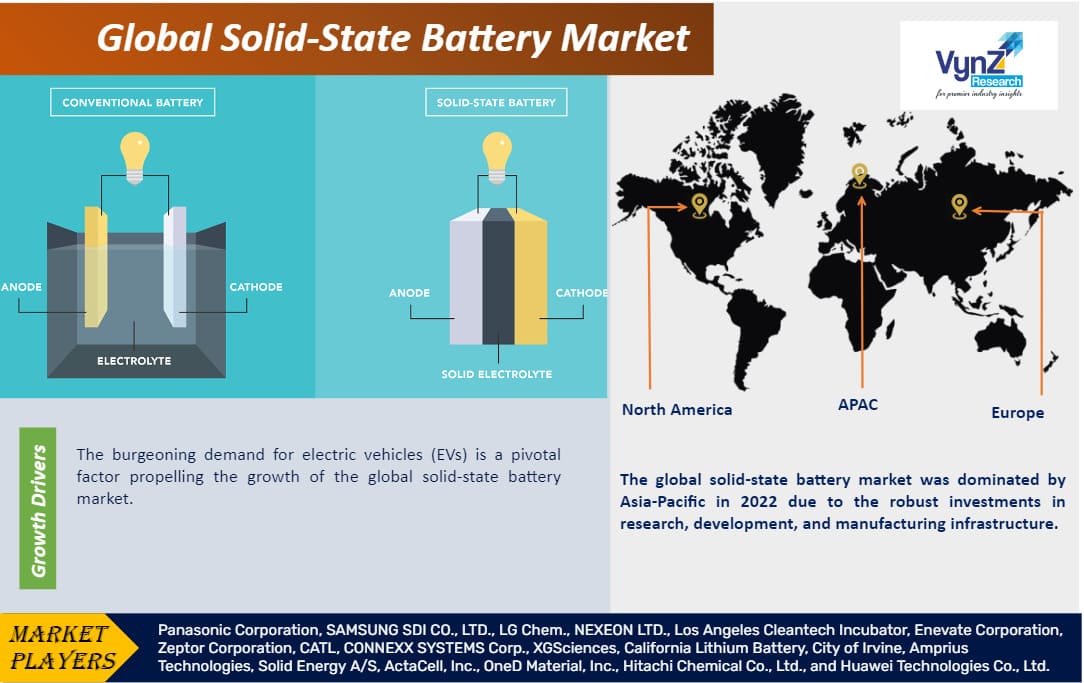

Solid-state batteries are advanced energy storage devices that replace traditional liquid electrolytes with solid materials, enhancing safety and performance. Unlike conventional lithium-ion batteries, which use liquid electrolytes, solid-state batteries employ solid electrolytes, reducing the risk of overheating and enhancing energy density. This design also enables faster charging, longer lifespan, and increased energy efficiency. The absence of liquid components eliminates the need for heavy protective casings, making solid-state batteries more compact and lightweight. This technology holds great promise for electric vehicles, portable electronics, and renewable energy storage, as it addresses key limitations of current battery technologies, paving the way for more efficient and sustainable energy solutions.

Global solid-state battery market was worth USD 1.70 billion in 2023 and is expected to reach USD 16.50 billion by 2030 with a CAGR of 37.79% during the forecast period, i.e., 2025-2030. The enhanced safety due to the absence of liquid electrolytes, increased energy density enabling longer-lasting devices, faster charging capabilities, and potential applications in electric vehicles for improved performance and sustainability are fostering a shift toward more efficient and reliable energy storage solutions and supporting the growth of the global solid-state battery market.

Geographically, the global solid-state battery market is expanding rapidly in North America, Europe, and the Asia Pacific due to increasing investments in electric vehicles, renewable energy, and portable electronics. Growing demand for safer, high-performance energy storage solutions and supportive government policies are driving significant advancements and market growth in these regions; however, the market confronts constraints such as high production costs, technological complexities, and the need for scalable manufacturing processes. Overall, the solid-state battery market offers potential prospects for market participants to develop and fulfill the growing needs of wide range of industries including automotive, energy storage, electrical and electronics, and other industries.

Market Segmentation

Insight by Type

Based on type, the global solid-state battery market is segmented into thin-film batteries, portable batteries, and other. Portable solid-state batteries dominated the global solid-state battery market in 2022 due to their applicability in consumer electronics, wearables, and medical devices. The demand for compact, lightweight, and high-performance power sources has surged. Notable examples include companies like QuantumScape and Solid Power focusing on applications in electric vehicles, highlighting the technology's potential beyond portables. Additionally, companies like Samsung and Panasonic are investing heavily in portable solid-state batteries for smartphones and other gadgets. The flexibility, safety advantages, and increased energy density of solid-state batteries make them crucial in addressing the growing demand for efficient and safer power solutions in portable electronics.

Insight by Category

Based on category, the global solid-state battery market is segmented into single-cell battery and multi-cell battery. In 2022, single-cell batteries dominated the global solid-state battery market in 2022 owing to simpler designs, easier manufacturing processes, and lower costs compared to their multi-cell counterparts. Examples include startups like Quantumscape, which focuses on single-layer pouch cells for electric vehicles. While multi-cell configurations offer higher voltage and energy output, challenges in maintaining uniformity and scalability have limited their widespread adoption. The industry is witnessing a trend towards refining single-cell technologies, driven by companies like Solid Power, showcasing the current dominance and emphasis on optimizing the efficiency and reliability of single-cell solid-state batteries in various applications.

Insight by Capacity

Based on capacity, the global solid-state battery market is segmented into less than 20 mAh, between 20 mAh-500 mAh, and above 500 mAh. Between 20 mAh-500mAh segment dominated the global solid-state battery market in 2022 owing to their prevalence in portable electronics, wearables, and medical devices, where compact size and moderate power are crucial. Companies like Ilika and Cymbet specialize in developing solid-state batteries within this capacity range, catering to the demand for energy-dense and smaller form factors. This size segment aligns with the requirements of modern consumer electronics, striking a balance between power density and physical dimensions, making them suitable for a wide range of applications and driving their dominance in the current global solid-state battery market.

Insight by Application

Based on application, the global solid-state battery market is segmented into consumer electronics, electric vehicle, energy harvesting, entertainment, medical devices, packaging, portable devices, smart cards, wearable devices, wireless communication, and other applications. Consumer electronics segment dominated the global solid-state battery market in 2022 due to the demand for compact, high-performance energy storage solutions. These batteries are essential for powering devices like smartphones, laptops, and wearables. Companies like Samsung and Murata are actively investing in solid-state battery technology for consumer electronics applications. Solid-state batteries offer advantages such as improved safety, longer lifespan, and faster charging, aligning with the evolving needs of the electronics industry. As a result, consumer electronics continue to drive innovation and adoption in the solid-state battery market, with ongoing research and development aimed at enhancing performance and addressing specific industry requirements.

Solid State Battery Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018–2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2023 |

$1.70 Billion |

|

Revenue Forecast in 2030 |

$16.50 Billion |

|

Growth Rate |

CAGR 37.79% |

|

Segments Covered in the Report |

By Type, By Capacity, By Category, By Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and South America |

Industry Dynamics

Growth Drivers

Burgeoning electric vehicle (EVs) demand

The burgeoning demand for electric vehicles (EVs) is a pivotal factor propelling the growth of the global solid-state battery market. As of November 2023, the automotive industry is witnessing a paradigm shift towards sustainable transportation, with countries and manufacturers globally announcing ambitious plans to transition to electric mobility. The demand for more efficient and safer energy storage solutions has intensified, aligning with the evolving needs of EVs. A notable example is the collaboration between BMW and Solid Power, announced in October 2023, to develop solid-state battery technology for high-performance EVs

Solid-state batteries offer advantages like increased energy density, longer lifespan, and enhanced safety, addressing key challenges in the EV sector. As governments worldwide implement stringent emissions regulations and consumers increasingly opt for electric alternatives, the need for reliable and energy-dense batteries becomes paramount, thus accelerating the integration of solid-state batteries into electric vehicles and catalyzing the overall growth of the global solid-state battery market.

Growing need for advanced energy storage solutions

The demand for advanced energy storage solutions is a driving force behind the growth of the global solid-state battery market, responding to diverse needs across industries. As of November 2023, the energy landscape is evolving rapidly, emphasizing sustainability and efficiency. In this context, solid-state batteries stand out for their potential to revolutionize energy storage, offering enhanced safety, longer cycle life, and improved performance compared to traditional batteries. A pertinent example is the partnership between Volkswagen and QuantumScape, announced in September 2023. Volkswagen aims to leverage QuantumScape's solid-state battery technology to enhance the range and charging capabilities of its electric vehicles.

Beyond automotive applications, industries such as renewable energy storage and grid solutions are increasingly recognizing the benefits of solid-state batteries in terms of reliability and energy density. As the global focus on clean energy intensifies, the need for innovative and efficient energy storage solutions becomes imperative, positioning solid-state batteries as a key player in shaping the future of sustainable energy storage across various sectors and propelling the continuous growth of the global solid-state battery market.

Challenge

Highly costly and complex production scale-up process

A significant challenge for the global solid-state battery market lies in the complexities and costs associated with scaling up production. Despite advancements in technology, achieving mass production with consistent quality and competitive pricing remains a hurdle for the companies in the global solid-state battery market. Companies encounter difficulties in maintaining uniformity and reliability at larger scales, hindering widespread adoption. Addressing these challenges is crucial for solid-state batteries to fulfill their potential across diverse applications, from electric vehicles to consumer electronics, and ensuring their competitiveness in the evolving energy storage landscape.

Geographic Overview

-

North America

-

Europe

-

Asia Pacific (APAC)

-

Middle East and Africa (MEA)

-

South America

The global solid-state battery market is segmented into North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. The global solid-state battery market was dominated by Asia-Pacific in 2022 due to the robust investments in research, development, and manufacturing infrastructure. Companies in the region, such as Samsung, CATL, and LG Chem, lead in the production of solid-state batteries, particularly for consumer electronics and electric vehicles. Supportive government initiatives and a strong focus on innovation have positioned Asia-Pacific as a key hub for advancements in energy storage technologies. With a strategic emphasis on sustainable practices and technological leadership, the region continues to drive the growth and dominance of the global solid-state battery market.

Competitive Insight

LG Chem is one of the leading players in the global solid-state battery market with strategic moves. In September 2023, LG Chem announced a groundbreaking partnership with a major electric vehicle manufacturer, solidifying its role as a key supplier of advanced energy storage solutions for electric mobility. This collaboration underscores LG Chem's commitment to advancing the adoption of solid-state batteries in electric vehicles, contributing to the evolution of sustainable transportation. The partnership enhances LG Chem's market influence and exemplifies its pivotal role in shaping the future of high-performance energy storage technologies, further solidifying its standing as a major player in the global solid-state battery market.

Samsung solidifies its market position as one of the leading players in the global solid-state battery sector through strategic initiatives, world-class offering portfolio and presence in key application segments. In a recent development, Samsung SDI forged partnerships with leading electric vehicle manufacturer, including Hyundai, General Motors, etc., to supply solid-state batteries, showcasing the company's commitment to advancing the electrification of the automotive industry. These partnerships, announced in 2023, emphasizes Samsung's role in providing cutting-edge energy storage solutions for electric vehicles, contributing to the growth and innovation of the global solid-state battery market. The collaboration underscores Samsung's influence as a key player in shaping the future of sustainable and high-performance energy storage technologies.

Recent Development by Key Players

In November 2023, GAC Group and Changan Automobile, major Chinese automakers, unveiled plans to manufacture solid-state batteries, joining the global race to integrate this transformative technology into electric vehicles (EVs). This move aligns with a broader industry trend of automakers developing their batteries, aiming for a self-sufficient supply chain.

In November 2023, Toyota Motor and Idemitsu Kosan formed an alliance to jointly develop and mass-produce all-solid-state batteries for electric vehicles (EVs), with plans to commercialize the next-generation batteries in 2027-28, followed by full-scale mass production. This collaboration follows Toyota's June 2023 announcement to introduce high-performance solid-state batteries to enhance EV driving range and reduce costs. The alliance aims to overcome durability challenges associated with solid-state batteries, marking a strategic move by Toyota, the world's largest automaker, towards advancing EV technology and addressing key concerns in the transition to electric mobility.

Key Players Covered in the Report

Panasonic Corporation, SAMSUNG SDI CO., LTD., LG Chem., NEXEON LTD., Los Angeles Cleantech Incubator, Enevate Corporation, Zeptor Corporation, CATL, CONNEXX SYSTEMS Corp., XGSciences, California Lithium Battery, City of Irvine, Amprius Technologies, Solid Energy A/S, ActaCell, Inc., OneD Material, Inc., Hitachi Chemical Co., Ltd., and Huawei Technologies Co., Ltd.

The solid-state battery market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

By Type

-

Thin-Film Batteries

-

Portable Batteries

-

Other

-

By Category

-

Single-cell Battery

-

Multi-cell Battery

-

By Capacity

-

Less Than 20 mAh

-

Between 20 mAh -500 mAh

-

Above500 mAh

-

By Application

-

Consumer Electronics

-

Electric Vehicle

-

Energy Harvesting

-

Entertainment

-

Medical Devices

-

Packaging

-

Portable Devices

-

Smart Cards

-

Wearable Devices

-

Wireless Communication

-

Other Applications

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Solid State Battery Market