- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Substation Automation and Integration Market

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9080 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 275 |

Global Substation Automation and Integration Market – Analysis and Forecast (2025-2030)

Industry Insight by Offering (Hardware (Reclose Controllers, Programmable Logical Controllers, Capacitor Banks, Smart Meters, Load Tap Changers, Digital Relays, Fiber-Optic Cables, and Others), Software (Production Management Software, Asset Management Software, and Performance Management Software), and Services (Installation and Commissioning, Up-Gradation and Retrofitting, and Testing, Repair, and Maintenance)), by Type (Transmission Substation and Distribution Substation), by Installation Type (New Installation and Retrofit Installation), by Component (IEDs (Intelligent Electronic Devices), Communication Networks, and SCADA Systems), by Communication (Ethernet, Power Line Communication, Copper Wire, and Optic Fiber), by End-User Industry (Utilities, Steel, Oil & Gas, Mining, Transportation, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Substation Automation And Integration Market reached USD 36.3 billion in 2023 and is projected to reach USD 60.2 billion by 2030, with a compound annual growth rate (CAGR) of 6.6% during the period from 2025 to 2030.

The growth of the substation automation and integration market is due to the increasing influence of smart grid infrastructure, aging infrastructure, technology development and integration of primary equipment with modern sensors, protective relays, reduction in transmission and distribution loss, cost-saving, and intelligent electronic device as it smoothly controls the functions and monitors across the substation. Moreover, the increasing requirement to retrofit conventional substations, rapid industrialization, government initiatives to promote substation automation, and R&D activities will drive the market growth of the global substation automation and integration market.

The COVID-19 pandemic has led to a strict lockdown in various countries and various industries are affected by the outburst. The substation automation and integration market have grown owing to the rising demand for data centers that will support digital activities. However, electricity consumption is anticipated to reduce due to commercial spaces working at low capacity and electric utilities might witness a delay in upgrading their grid infrastructure, resulting in having an adverse impact on substation automation and integration market.

Substation Automation and Integration Market Segmentation

Insight by Offering

Based on offering, the global substation automation and integration market is segmented into hardware, software, and services. Hardware is further subdivided into reclose controllers, programmable logical controllers, capacitor banks, smart meters, load tap changers, digital relays, fiber-optic cables, and others. Software is further sub-divided into production management software, asset management software, and performance management software. Services are further subdivided into installation and commissioning, up-gradation and retrofitting, and testing, repair, and maintenance. The hardware segment holds the largest market share in 2020 owing to the introduction of the IEC 61850 standard for substations which incorporates all the control, measurement, and monitors in one protocol, resulting in proper interoperability between intelligent electronic devices (IEDs).

Insight by Type

Based on type, the global substation automation and integration market is divided into transmission substation and distribution substation. Transmission substations dominate the market owing to the rising electricity demand, there is a need to replace the aging infrastructure which cannot sustain the bulk power movements or inferior standards. Thus, investor-owned utilities are experiencing increased spending on transmission substations infrastructure.

Insight by Installation Type

Based on installation type, the global substation automation and integration market is bifurcated into new installation and retrofit installation. Among these segments, the new installation is anticipated to have a high CAGR owing to the rising demand for new power stations and smart grids in various industries. Moreover, the new installation can provide operational safety, reliability and requires low maintenance.

Insight by Component

Based on components, the global substation automation and integration is categorized into IEDs (Intelligent Electronic Devices), communication networks, and SCADA systems. IEDs are one of the major components in the substation automation and integration market and contain digital relays, programmable logic controllers, smart meters/digital transducers, load tap changer controller, capacitor bank controller, and reclose controller. IED offers barrier-free monitoring and control capabilities throughout the substation.

Insight by Communication

Based on communication, the global substation automation and integration market are divided into ethernet, power line communication, copper wire, and optic fiber. The copper wire segment is anticipated to have a high CAGR owing to its low attenuation and interference. Furthermore, the increasing investment in telecommunication and IT will contribute to this segment during the forecast period.

Insight by End-User Industry

Based on the end-user industry, the global substation automation and integration market are segmented into utilities, steel, oil & gas, mining, transportation, and others. The utility segment dominates the market because of the demand-supply gap in the energy sector in developed and developing economies. Moreover, the rising government initiatives towards modernizing power grids and rising investment in power generation through renewable resources will accelerate the growth of the segment.

Global Substation Automation and Integration Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 36.3 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 60.2 Billion |

|

Growth Rate |

6.6% |

|

Segments Covered in the Report |

By offering, By Type, By Installation Type, By Component, Communication, and By End User Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Substation Automation and Integration Market Growth Drivers

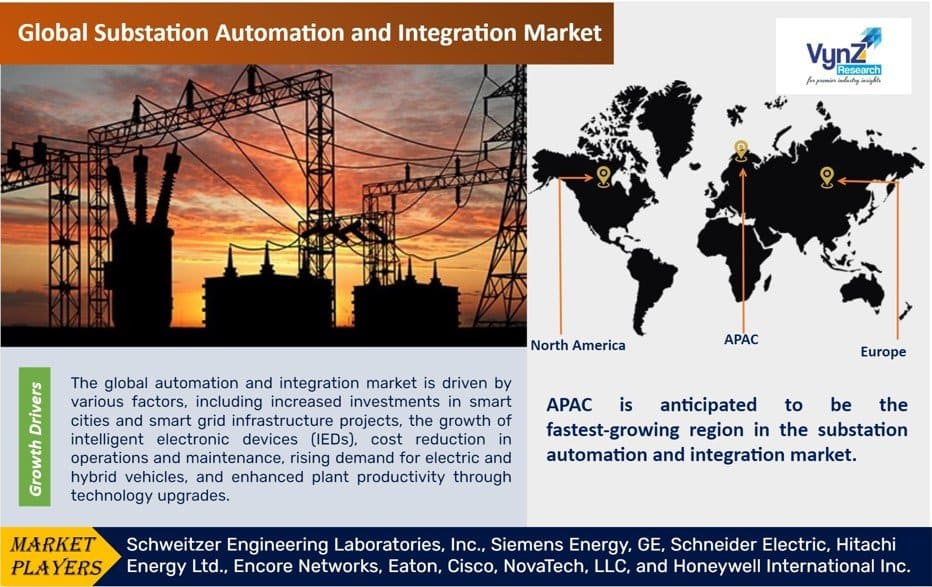

The global automation and integration market is driven by various factors, including increased investments in smart cities and smart grid infrastructure projects, the growth of intelligent electronic devices (IEDs), cost reduction in operations and maintenance, rising demand for electric and hybrid vehicles, and enhanced plant productivity through technology upgrades. Additionally, it offers interlocking and smart load shedding capabilities to ensure grid reliability, performance, and security. According to the International Railway Journal, Germany's federal government has invested $80 million in digital applications to enhance network capacity.

Substation Automation and Integration Market Challenges

The huge capital investment and rigorous governance will hamper the growth of the market. With the increasing use of advanced technologies such as microprocessors and service-oriented architecture (SOA), and the increasing need to integrate various IEDs in substations, the cost of purchasing these substations has increased. The COVID-19 outbreak has slowed down the growth of the power generation industry and renewable energy sector. For instance, China is the primary global producer of clean energy technologies like solar panels, wind turbines, and batteries. Renewable energy companies in China are not able to comply with their deadlines for equipment installation.

Substation Automation and Integration Market Opportunities

The increasing demand for renewable energy projects and the rising adoption of electric and hybrid vehicles are creating lucrative opportunities in the substation automation and integration market. Companies are focusing on investing in sustainable energy infrastructure, investing in solar and wind projects to meet the rising demand for electricity, and minimizing environmental impacts are the opportunities for the growth of the sustainable automation and integration market.

Substation Automation and Integration Market Geographic Overview

APAC is anticipated to be the fastest-growing region in the substation automation and integration market owing to the initiatives by the government to enhance the power and energy sector. For instance, the Indian Government is following a smart infrastructure vision wherein the digitalization of the grid in industrial, commercial, and residential areas, the revival of power distribution utilities, and the electrification of villages will take place. Furthermore, in 2020, the Chinese Government invested $31 billion to revolutionize its grid infrastructure by installing automated substations.

Substation Automation and Integration Market Competitive Insight

The industry players are adopting strategies such as product launches and developments, partnerships, contracts, and mergers and acquisitions to have a strong foothold in the substation automation and integration market.

Hitachi ABB Power Grids launched the new Remote Terminal Unit (RTU) 530 which extends the life of existing power distribution networks and supports the migration to modern technologies with enhanced security features, including secure communication, encryption, and security logging.

Schneider Electric acquired a controlling stake in ETAP Automation Inc. (Dubai), the leading software platform for electrical power systems modeling and simulation, to accelerate and improve the integration of renewables, microgrids, fuel cells, and battery storage technologies to the power grid. The acquisition would pave the way for green data centers, resilient power grids, and decarbonized transport and energy generation.

Some of the key players operating in the substation automation and integration market: are Schweitzer Engineering Laboratories, Inc., Siemens Energy, GE, Schneider Electric, Hitachi Energy Ltd., Encore Networks, Eaton, Cisco, NovaTech, LLC, and Honeywell International Inc.

The Substation Automation and Integration Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Offering

- Hardware

- Reclose Controllers

- Programmable Logical Controllers

- Capacitor Banks

- Smart Meters

- Load Tap Changers

- Digital Relays

- Fiber-Optic Cables

- Others

- Software

- Production Management Software

- Asset Management Software

- Performance Management Software

- Services

- Installation and Commissioning

- Up-Gradation and Retrofitting

- Testing, Repair, and Maintenance

- Hardware

- By Type

- Transmission Substation

- Distribution Substation

- By Installation Type

- New Installation

- Retrofit Installation

- By Component

- IEDs (Intelligent Electronic Devices)

- Communication Networks

- SCADA Systems

- By Communication

- Ethernet

- Power Line Communication

- Copper Wire

- Optic Fiber

- By End-User Industry

- Utilities

- Steel

- Oil & Gas

- Mining

- Transportation

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Offering

1.2.2. By Type

1.2.3. By Installation Type

1.2.4. By Component

1.2.5. By Communication

1.2.6. By End-User Industry

1.2.7. By Region

1.3. Research Phases

1.4. Limitations

1.5. Research Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Offering

5.1.1. Hardware

5.1.1.1 Reclose Controllers

5.1.1.1.1 Market Definition

5.1.1.1.2 Market Estimation and Forecast to 2030

5.1.1.2 Programmable Logical Controllers

5.1.1.2.1 Market Definition

5.1.1.2.2 Market Estimation and Forecast to 2030

5.1.1.3 Capacitor Banks

5.1.1.3.1 Market Definition

5.1.1.3.2 Market Estimation and Forecast to 2030

5.1.1.4 Smart Meters

5.1.1.4.1 Market Definition

5.1.1.4.2 Market Estimation and Forecast to 2030

5.1.1.5 Load Tap Changers

5.1.1.5.1 Market Definition

5.1.1.5.2 Market Estimation and Forecast to 2030

5.1.1.6 Digital Relays

5.1.1.6.1 Market Definition

5.1.1.6.2 Market Estimation and Forecast to 2030

5.1.1.7 Fiber-Optic Cables

5.1.1.7.1 Market Definition

5.1.1.7.2 Market Estimation and Forecast to 2030

5.1.1.8 Others

5.1.1.8.1 Market Definition

5.1.1.8.2 Market Estimation and Forecast to 2030

5.1.2. Software

5.1.2.1 Production Management Software

5.1.2.1.1 Market Definition

5.1.2.1.2 Market Estimation and Forecast to 2030

5.1.2.2 Asset Management Software

5.1.2.2.1 Market Definition

5.1.2.2.2 Market Estimation and Forecast to 2030

5.1.2.3 Performance Management Software

5.1.2.3.1 Market Definition

5.1.2.3.2 Market Estimation and Forecast to 2030

5.1.3. Services

5.1.3.1 Installation and Commissioning

5.1.3.1.1 Market Definition

5.1.3.1.2 Market Estimation and Forecast to 2030

5.1.3.2 Up-Gradation and Retrofitting

5.1.3.2.1 Market Definition

5.1.3.2.2 Market Estimation and Forecast to 2030

5.1.3.3 Testing, Repair, and Maintenance

5.1.3.3.1 Market Definition

5.1.3.3.2 Market Estimation and Forecast to 2030

5.2. By Type

5.2.1. Transmission Substation

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Distribution Substation

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.3. By Installation Type

5.3.1. New Installation

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Retrofit Installation

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.4. By Component

5.4.1. IEDs (Intelligent Electronic Devices)

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2030

5.4.2. Communication Networks

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2030

5.4.3. SCADA Systems

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2030

5.5. By Communication

5.5.1. Ethernet

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2030

5.5.2. Power Line Communication

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2030

5.5.3. Copper Wire

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2030

5.5.4. Optic Fiber

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2030

5.6. By End-User Industry

5.6.1. Utilities

5.6.1.1. Market Definition

5.6.1.2. Market Estimation and Forecast to 2030

5.6.2. Steel

5.6.2.1. Market Definition

5.6.2.2. Market Estimation and Forecast to 2030

5.6.3. Oil & Gas

5.6.3.1. Market Definition

5.6.3.2. Market Estimation and Forecast to 2030

5.6.4. Mining

5.6.4.1. Market Definition

5.6.4.2. Market Estimation and Forecast to 2030

5.6.5. Transportation

5.6.5.1. Market Definition

5.6.5.2. Market Estimation and Forecast to 2030

5.6.6. Others

5.6.6.1. Market Definition

5.6.6.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Offering

6.2. By Type

6.3. By Installation Type

6.4. By Component

6.5. By Communication

6.6. By End-User Industry

6.7. By Country

6.7.1. U.S. Market Estimate and Forecast

6.7.2. Canada Market Estimate and Forecast

6.7.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Offering

7.2. By Type

7.3. By Installation Type

7.4. By Component

7.5. By Communication

7.6. By End-User Industry

7.7. By Country

7.7.1. Germany Market Estimate and Forecast

7.7.2. France Market Estimate and Forecast

7.7.3. U.K. Market Estimate and Forecast

7.7.4. Italy Market Estimate and Forecast

7.7.5. Spain Market Estimate and Forecast

7.7.6. Russia Market Estimate and Forecast

7.7.7. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Offering

8.2. By Type

8.3. By Installation Type

8.4. By Component

8.5. By Communication

8.6. By End-User Industry

8.7. By Country

8.7.1. China Market Estimate and Forecast

8.7.2. Japan Market Estimate and Forecast

8.7.3. India Market Estimate and Forecast

8.7.4. South Korea Market Estimate and Forecast

8.7.5. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Offering

9.2. By Type

9.3. By Installation Type

9.4. By Component

9.5. By Communication

9.6. By End-User Industry

9.7. By Country

9.7.1. Brazil Market Estimate and Forecast

9.7.2. Saudi Arabia Market Estimate and Forecast

9.7.3. South Africa Market Estimate and Forecast

9.7.4. U.A.E. Market Estimate and Forecast

9.7.5. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Schweitzer Engineering Laboratories, Inc.

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Siemens Energy

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. GE

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. Schneider Electric

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Hitachi Energy Ltd.

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. Encore Networks

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Eaton

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Cisco

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. NovaTech, LLC

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. Honeywell International Inc.

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Substation Automation and Integration Market , By Offering, 2018 - 2023 (USD Billion)

Table 5 Global Substation Automation and Integration Market , By Offering, 2025 - 2030 (USD Billion)

Table 6 Global Substation Automation and Integration Market , By Type, 2018 - 2023 (USD Billion)

Table 7 Global Substation Automation and Integration Market , By Type, 2025 - 2030 (USD Billion)

Table 8 Global Substation Automation and Integration Market , By Installation Type, 2018 - 2023 (USD Billion)

Table 9 Global Substation Automation and Integration Market , By Installation Type, 2025 - 2030 (USD Billion)

Table 10 Global Substation Automation and Integration Market , By Component, 2018 - 2023 (USD Billion)

Table 11 Global Substation Automation and Integration Market , By Component, 2025 - 2030 (USD Billion)

Table 12 Global Substation Automation and Integration Market , By Communication, 2018 - 2023 (USD Billion)

Table 13 Global Substation Automation and Integration Market , By Communication, 2025 - 2030 (USD Billion)

Table 14 Global Substation Automation and Integration Market, By End-User Industry, 2018 - 2023 (USD Billion)

Table 15 Global Substation Automation and Integration Market , By End-User Industry, 2025 - 2030 (USD Billion)

Table 16 Global Substation Automation and Integration Market , By Region, 2018 - 2023 (USD Billion

Table 17 Global Substation Automation and Integration Market , By Region, 2025 - 2030 (USD Billion)

Table 18 North America Substation Automation and Integration Market , By Offering, 2018 - 2023 (USD Billion)

Table 19 North America Substation Automation and Integration Market , By Offering, 2025 - 2030 (USD Billion)

Table 20 North America Substation Automation and Integration Market , By Type, 2018 - 2023 (USD Billion)

Table 21 North America Substation Automation and Integration Market , By Type, 2025 - 2030 (USD Billion)

Table 22 North America Substation Automation and Integration Market , By Installation Type, 2018 - 2023 (USD Billion)

Table 23 North America Substation Automation and Integration Market , By Installation Type, 2025 - 2030 (USD Billion)

Table 24 North America Substation Automation and Integration Market , By Component, 2018 - 2023 (USD Billion)

Table 25 North America Substation Automation and Integration Market , By Component, 2025 - 2030 (USD Billion)

Table 26 North America Substation Automation and Integration Market , By Communication, 2018 - 2023 (USD Billion)

Table 27 North America Substation Automation and Integration Market , By Communication, 2025 - 2030 (USD Billion)

Table 28 North America Substation Automation and Integration Market , By End-User Industry, 2018 - 2023 (USD Billion)

Table 29 North America Substation Automation and Integration Market , By End-User Industry, 2025 - 2030 (USD Billion)

Table 30 North America Substation Automation and Integration Market , By Region, 2018 - 2023 (USD Billion)

Table 31 North America Substation Automation and Integration Market , By Region, 2025 - 2030 (USD Billion)

Table 32 Europe Substation Automation and Integration Market , By Offering, 2018 - 2023 (USD Billion)

Table 33 Europe Substation Automation and Integration Market , By Offering, 2025 - 2030 (USD Billion)

Table 34 Europe Substation Automation and Integration Market , By Type, 2018 - 2023 (USD Billion)

Table 35 Europe Substation Automation and Integration Market , By Type, 2025 - 2030 (USD Billion)

Table 36 Europe Substation Automation and Integration Market , By Installation Type, 2018 - 2023 (USD Billion)

Table 37 Europe Substation Automation and Integration Market , By Installation Type, 2025 - 2030 (USD Billion)

Table 38 Europe Substation Automation and Integration Market , By Component, 2018 - 2023 (USD Billion)

Table 39 Europe Substation Automation and Integration Market , By Component, 2025 - 2030 (USD Billion)

Table 40 Europe Substation Automation and Integration Market , By Communication, 2018 - 2023 (USD Billion)

Table 41 Europe Substation Automation and Integration Market , By Communication, 2025 - 2030 (USD Billion)

Table 42 Europe Substation Automation and Integration Market , By End-User Industry, 2018 - 2023 (USD Billion)

Table 43 Europe Substation Automation and Integration Market , By End-User Industry, 2025 - 2030 (USD Billion)

Table 44 Europe Substation Automation and Integration Market , By Region, 2018 - 2023 (USD Billion)

Table 45 Europe Substation Automation and Integration Market , By Region, 2025 - 2030 (USD Billion)

Table 46 Asia-Pacific Substation Automation and Integration Market , By Offering, 2018 - 2023 (USD Billion)

Table 47 Asia-Pacific Substation Automation and Integration Market , By Offering, 2025 - 2030 (USD Billion)

Table 48 Asia-Pacific Substation Automation and Integration Market , By Type, 2018 - 2023 (USD Billion)

Table 49 Asia-Pacific Substation Automation and Integration Market , By Type, 2025 - 2030 (USD Billion)

Table 50 Asia-Pacific Substation Automation and Integration Market , By Installation Type, 2018 - 2023 (USD Billion)

Table 51 Asia-Pacific Substation Automation and Integration Market , By Installation Type, 2025 - 2030 (USD Billion)

Table 52 Asia-Pacific Substation Automation and Integration Market , By Component, 2018 - 2023 (USD Billion)

Table 53 Asia-Pacific Substation Automation and Integration Market , By Component, 2025 - 2030 (USD Billion)

Table 54 Asia-Pacific Substation Automation and Integration Market , By Communication, 2018 - 2023 (USD Billion)

Table 55 Asia-Pacific Substation Automation and Integration Market , By Communication, 2025 - 2030 (USD Billion)

Table 56 Asia-Pacific Substation Automation and Integration Market , By End-User Industry, 2018 - 2023 (USD Billion)

Table 57 Asia-Pacific Substation Automation and Integration Market , By End-User Industry, 2025 - 2030 (USD Billion)

Table 58 Asia-Pacific Substation Automation and Integration Market , By Region, 2018 - 2023 (USD Billion)

Table 59 Asia-Pacific Substation Automation and Integration Market , By Region, 2025 - 2030 (USD Billion)

Table 60 RoW Substation Automation and Integration Market , By Offering, 2018 - 2023 (USD Billion)

Table 61 RoW Substation Automation and Integration Market , By Offering, 2025 - 2030 (USD Billion)

Table 62 RoW Substation Automation and Integration Market , By Type, 2018 - 2023 (USD Billion)

Table 63 RoW Substation Automation and Integration Market , By Type, 2025 - 2030 (USD Billion)

Table 64 RoW Substation Automation and Integration Market , By Installation Type, 2018 - 2023 (USD Billion)

Table 65 RoW Substation Automation and Integration Market , By Installation Type, 2025 - 2030 (USD Billion)

Table 66 RoW Substation Automation and Integration Market, By Component, 2018 - 2023 (USD Billion)

Table 67 RoW Substation Automation and Integration Market, By Component, 2025 - 2030 (USD Billion)

Table 68 RoW Substation Automation and Integration Market, By Communication, 2018 - 2023 (USD Billion)

Table 69 RoW Substation Automation and Integration Market, By Communication, 2025 - 2030 (USD Billion)

Table 70 RoW Substation Automation and Integration Market , By End-User Industry, 2018 - 2023 (USD Billion)

Table 71 RoW Substation Automation and Integration Market , By End-User Industry, 2025 - 2030 (USD Billion)

Table 72 RoW Substation Automation and Integration Market , By Region, 2018 - 2023 (USD Billion)

Table 73 RoW Substation Automation and Integration Market , By Region, 2025 - 2030 (USD Billion)

Table 74 Snapshot – Schweitzer Engineering Laboratories, Inc.

Table 75 Snapshot – Siemens Energy

Table 76 Snapshot – GE

Table 77 Snapshot – Schneider Electric

Table 78 Snapshot – Hitachi Energy Ltd.

Table 79 Snapshot – Encore Networks

Table 80 Snapshot – Eaton

Table 81 Snapshot – Cisco

Table 83 Snapshot – NovaTech, LLC

Table 84 Snapshot – Honeywell International Inc.

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Substation Automation and Integration Market - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Substation Automation and Integration Market Highlight

Figure 12 Global Substation Automation and Integration Market, By Offering, 2018 - 2030 (USD Billion)

Figure 13 Global Substation Automation and Integration Market , By Type, 2018 - 2030 (USD Billion)

Figure 14 Global Substation Automation and Integration Market , By Installation Type, 2018 - 2030 (USD Billion)

Figure 15 Global Substation Automation and Integration Market , By Component, 2018 - 2030 (USD Billion)

Figure 16 Global Substation Automation and Integration Market , By Communication, 2018 - 2030 (USD Billion)

Figure 17 Global Substation Automation and Integration Market , By End-User Industry, 2018 - 2030 (USD Billion)

Figure 18 Global Substation Automation and Integration Market , By Region, 2018 - 2030 (USD Billion)

Figure 19 North America Substation Automation and Integration Market Highlight

Figure 20 North America Substation Automation and Integration Market , By Offering, 2018 - 2030 (USD Billion)

Figure 21 North America Substation Automation and Integration Market , By Type, 2018 - 2030 (USD Billion)

Figure 22 North America Substation Automation and Integration Market , By Installation Type, 2018 - 2030 (USD Billion)

Figure 23 North America Substation Automation and Integration Market , By Component, 2018 - 2030 (USD Billion)

Figure 24 North America Substation Automation and Integration Market , By Communication, 2018 - 2030 (USD Billion)

Figure 25 North America Substation Automation and Integration Market , By End-User Industry, 2018 - 2030 (USD Billion)

Figure 26 North America Substation Automation and Integration Market , By Region, 2018 - 2030 (USD Billion)

Figure 27 Europe Substation Automation and Integration Market Highlight

Figure 28 Europe Substation Automation and Integration Market , By Offering, 2018 - 2030 (USD Billion)

Figure 29 Europe Substation Automation and Integration Market , By Type, 2018 - 2030 (USD Billion)

Figure 30 Europe Substation Automation and Integration Market , By Installation Type, 2018 - 2030 (USD Billion)

Figure 31 Europe Substation Automation and Integration Market , By Component, 2018 - 2030 (USD Billion)

Figure 32 Europe Substation Automation and Integration Market , By Communication, 2018 - 2030 (USD Billion)

Figure 33 Europe Substation Automation and Integration Market , By End-User Industry, 2018 - 2030 (USD Billion)

Figure 34 Europe Substation Automation and Integration Market , By Region, 2018 - 2030 (USD Billion)

Figure 35 Asia-Pacific Substation Automation and Integration Market Highlight

Figure 36 Asia-Pacific Substation Automation and Integration Market , By Offering, 2018 - 2030 (USD Billion)

Figure 37 Asia-Pacific Substation Automation and Integration Market , By Type, 2018 - 2030 (USD Billion)

Figure 38 Asia-Pacific Substation Automation and Integration Market , By Installation Type, 2018 - 2030 (USD Billion)

Figure 39 Asia-Pacific Substation Automation and Integration Market , By Component, 2018 - 2030 (USD Billion)

Figure 40 Asia-Pacific Substation Automation and Integration Market , By Communication, 2018 - 2030 (USD Billion)

Figure 41 Asia-Pacific Substation Automation and Integration Market , By End-User Industry, 2018 - 2030 (USD Billion)

Figure 42 Asia-Pacific Substation Automation and Integration Market , By Region, 2018 - 2030 (USD Billion)

Figure 43 RoW Substation Automation and Integration Market Highlight

Figure 44 RoW Substation Automation and Integration Market , By Offering, 2018 - 2030 (USD Billion)

Figure 45 RoW Substation Automation and Integration Market , By Type, 2018 - 2030 (USD Billion)

Figure 46 RoW Substation Automation and Integration Market , By Installation Type, 2018 - 2030 (USD Billion)

Figure 47 RoW Substation Automation and Integration Market , By Component, 2018 - 2030 (USD Billion)

Figure 48 RoW Substation Automation and Integration Market , By Communication, 2018 - 2030 (USD Billion)

Figure 49 RoW Substation Automation and Integration Market , By End-User Industry, 2018 - 2030 (USD Billion)

Figure 50 RoW Substation Automation and Integration Market , By Region, 2018 - 2030 (USD Billion)

Global Substation Automation and Integration Market Coverage

Offering Insight and Forecast 2025-2030

- Hardware

- Reclose Controllers

- Programmable Logical Controllers

- Capacitor Banks

- Smart Meters

- Load Tap Changers

- Digital Relays

- Fiber-Optic Cables

- Others

- Software

- Production Management Software

- Asset Management Software

- Performance Management Software

- Services

- Installation and Commissioning

- Up-Gradation and Retrofitting

- Testing, Repair, and Maintenance

Type Insight and Forecast 2025-2030

- Transmission Substation

- Distribution Substation

Installation Type Insight and Forecast 2025-2030

- New Installation

- Retrofit Installation

Component Insight and Forecast 2025-2030

- IEDs (Intelligent Electronic Devices)

- Communication Networks

- SCADA Systems

Communication Insight and Forecast 2025-2030

- Ethernet

- Power Line Communication

- Copper Wire

- Optic Fiber

End-User Industry Insight and Forecast 2025-2030

- Utilities

- Steel

- Oil & Gas

- Mining

- Transportation

- Others

Geographical Segmentation

Substation Automation and Integration Market by Region

North America

- By Offering

- By Type

- By Installation type

- By Component

- By Communication

- By End-User Industry

- By Country – U.S., Canada, and Mexico

Europe

- By Offering

- By Type

- By Installation type

- By Component

- By Communication

- By End-User Industry

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Offering

- By Type

- By Installation type

- By Component

- By Communication

- By End-User Industry

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Offering

- By Type

- By Installation type

- By Component

- By Communication

- By End-User Industry

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Schweitzer Engineering Laboratories Inc.

- Siemens Energy

- GE

- Schneider Electric

- Hitachi Energy Ltd.

- Encore Networks

- Eaton

- Cisco

- NovaTech LLC

- Honeywell International Inc.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Substation Automation and Integration Market