- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

TIC Market for Physical Security

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9060 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 155 |

Global TIC Market for Physical Security– Analysis and Forecast (2025-2030)

Industry Insight by Sourcing Type (In-House and Outsourced), by Service Type (Testing, Inspection, and Certification), by Industry Vertical (Access Control, Video Surveillance, Intrusion Detection, Locks, Safes & Vaults, Door Locking Devices and Hardware, Ballistic Resistant Materials, Burglary Resistant Materials, ATMs, Anti-Theft Devices, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Physical Security Testing, Inspection, And Certification Market reached a value of USD 0.360 billion in 2023, with a projected compound annual growth rate (CAGR) of 6% from 2025 to 2030.

Testing in TIC means an industrial activity that assures manufactured products, individual components, and multi-component systems are suitable for the predetermined purpose. Inspection and testing are the operating parts of quality control which supports cost, productivity, on-time delivery, and market share, thus the critical factor for the survival of any manufacturing company. The testing, inspection, and certification market report is composed of conformity assessment agencies, which provide services from audit and inspection to testing, verification, quality assurance, and certification.

Globalization has led to product standardization norms and has penetrated developed technologies across various industries such as fire safety equipment, food and beverage, electronics and automotive industries, etc., resulting in the growth of the TIC market during the forecast period 2025-2030. Moreover, the growing middle-class population, rapid urbanization, mandatory safety regulations, upsurge in the illicit trade of counterfeit and pirated products, advancement in networking and communication technology, the inclination of outsourcing testing, inspection, and certification services has propelled the growth of the TIC market in the physical security. Nevertheless, TIC provides various advantages related to its credibility and image, compliance with legal and regulatory requirements, less turnover of employees, high level of cost control improvement, and fast improvement of different processes. There is an increase in demand for physical security owing to rising incidences of terror attacks, technological development and deployment of wireless technology in security systems, growing use of IP-based cameras for video surveillance, and increasing use of IoT-based security systems with cloud computing platforms which will propel the growth of TIC market for physical security.

TIC companies are catering to different industrial sectors such as agriculture, automotive, IT and electronics, physical security, building & construction, environmental protection, food testing, and oil and gas, maritime, medicine, education, tourism, logistics, consumer products, etc. and provide various standards and legislation.

The COVID-19 pandemic resulted in a short-term decline in demand and revenue in the first quarter of 2022. The internet ecosystem is playing an important role globally as a result there is widespread use of mobile devices and individuals are inclined towards the adoption of digital technologies. So, there is a need to have a cyber-safe remote working environment and physical security. Thus, TIC is playing a crucial role by offering assurance that the products and services offered to the customers will provide safety and security standards.

Business organizations in the TIC market are intensifying IT infrastructures and developing business continuity plans, implying that the testing, inspection, and certification market are holding the substantial potential to bounce back from the COVID-19 outbreak. This is due to the fact that TIC services will enhance and protect brand reputation, verify products’ safety, and enables trade.

TIC Market for Physical Security Segmentation

Insight by Sourcing Type

Based on sourcing type, the TIC market for physical security is bifurcated into in-house and outsourced. Among the two segments, the in-house segment dominates the market and is anticipated to hold the largest share during the forecast period 2023-2030. Deploying in-house testing and inspection will offer companies to have complete control over the entire process in terms of technology, skilled personnel, and testing and measurement equipment. Thus, enabling organizations to handle TIC activities like on-site availability, ability to employ talent, and establish custom practices as per the needs and desires of the organizations.

Insight by Service Type

Based on service type, the TIC market for physical security is segmented into testing, inspection, and certification. Among these segments, the testing segment holds the largest share in the testing, inspection, and certification market in 2022 owing to the diverse product standards, stringent regulations, increasing need for improved safety & security, growing industrialization, and a need to protect the brand. Moreover, the certification market is anticipated to have a high CAGR during the forecast period owing to the consumer awareness about the certified products, companies growing need to improve the product value, the surge in demand for quality and safe products, and mandatory regulatory requirements.

Insight by Industry Vertical

Based on industry vertical, the TIC market for physical security is divided into access control, video surveillance, intrusion detection, locks, safes & vaults, door locking devices and hardware, ballistic resistant materials, burglary resistant materials, ATMs, anti-theft devices, and others. There is an increase in the adoption of video surveillance systems such as remote real-time video inspection using smartphones, tablets to maintain the supply chain, quality control, safety, and proper manufacturing schedules. In the burglary resistance test, the products (wall and door barriers, boltwork, drawer sliders, lock, handle, base fixing strength, preparation for alarm installation) are tested and should comply with the industry standards.

Global TIC Market for Physical Security Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 0.360 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 0.xxx Billion |

|

Growth Rate |

6% |

|

Segments Covered in the Report |

By Sourcing Type, By Service Type, and By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

TIC Market for Physical Security Trends

The TIC market for physical security is characterized by various industry trends such as growing investment in AR and VR, mounting adoption of connected devices and cloud-based technology, increasing mergers and acquisitions by the industry players, and sustained consolidation of suppliers leading to globalization.

TIC Market for Physical Security Growth Drivers

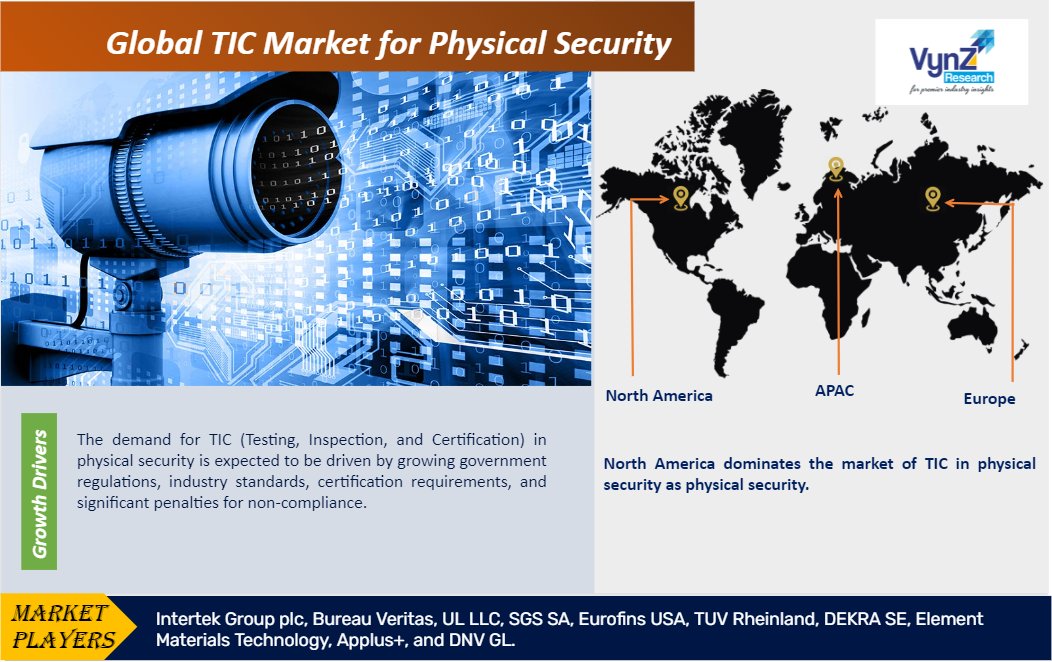

The demand for TIC (Testing, Inspection, and Certification) in physical security is expected to be driven by growing government regulations, industry standards, certification requirements, and significant penalties for non-compliance. This trend is further fueled by the increasing instances of terror attacks, the need to protect business assets, employees, and customers, as well as the adoption of IoT and cloud-based data storage. Government regulations and compliance enforcement, the advancement of smart cities, and the shift from traditional solutions also contribute to the growth of the TIC market for physical security.

As a result, manufacturing companies are increasingly focusing on offering high-quality products to enhance customer retention. This, in turn, leads to a greater demand for interoperability testing for connected devices and IoT. Furthermore, the process is accelerated by globalization, the rise of global trade, and the emergence of digital technologies. These factors collectively contribute to the expansion of the TIC market in the field of physical security.

TIC Market for Physical Security Challenges

The testing, inspection, and certification market in physical security may face certain challenges like trade wars and growth fluctuations, huge investment for automation and installation of industrial safety systems, integration issues among security solutions, device vulnerability and chances of system being hacked, and high cost of TIC owing to diverse standards and regulations globally. Moreover, a lack of testing facilities and skilled personnel may hamper the growth of the TIC market.

TIC Market for Physical Security Opportunities

Testing, inspection, and certification is a massive market that provides lucrative opportunities in technologies such as AI, robotics, drones, big data analytics, next-generation automation, and cloud and cybersecurity. Moreover, the technological development and use of IP-based HD video in video surveillance, and the emergence of automated drones for security trolling will create promising opportunities for the growth of the TIC market in physical security.

TIC Market for Physical Security Geographic Overview

North America dominates the market of TIC in physical security as physical security is important owing to the need for safety against terror activities, illegal immigration, technological advancement, etc. These threats can be overcome by access control, perimeter intrusion detection, and video surveillance.

APAC is anticipated to have a high CAGR during the forecast period owing to the rising investment in R&D, rapid urbanization & industrialization, huge manufacturing capabilities and exports, and increasing consumer awareness about the importance of quality certification, testing, and inspection. Moreover, the developed countries have their manufacturing units in the region, especially in China and India. These manufacturing units manufacture products according to internationally accepted standards.

TIC Market for Physical Security Competitive Insight

Key players are adopting technological changes to improve their product portfolio and generate new revenues, optimize the operational cost, and enhance service efficiencies via process upgrades. The industry players are taking the COVID-19 crisis as an opportunity to restructure and revisit their existing strategies, focus on new services and delivery models to access the demand for rising automation, remotely-performed services, and enhanced digitization.

The business enterprises have started opening development centers in new locations to enhance market penetration which helps in building business relations with customers and clients. Moreover, the industry players in the TIC market have started building strategies like mergers and acquisitions, product innovation, and geographical expansion to hold a major share in the TIC market for physical security.

SGS SA is a world leader in project management and provides enhanced experience in all areas of construction. SGS SA helps in managing technical risks, avoiding construction errors, controlling budgets, and keeping construction projects within the planned schedule.

Bureau Veritas is a global leader in the testing, inspection, and certification of construction consultancy services. Bureau Veritas manages risk, adds value, provides cost-effectiveness, and gives clients help at all stages of the design and construction process.

Some of the key players operating in the TIC market in the physical security Intertek Group plc, Bureau Veritas, UL LLC, SGS SA, Eurofins USA, TUV Rheinland, DEKRA SE, Element Materials Technology, Applus+, and DNV GL.

Recent Developments by Key Players

Intertek (a leading Total Quality Assurance provider to industries worldwide) has collaborated with Korea Testing & Research Institute (KTR) (a top Korean testing and certification provider). This collaboration marks a significant step in streamlining global market access for electrical and electronic product manufacturers worldwide.

Bureau Veritas, a world leader in testing, inspection and certification, has acquired Secura B.V. (starting with a majority stake), an independent service company specializing in cybersecurity services. Secura will be a cornerstone in the cybersecurity strategy of Bureau Veritas.

The TIC Market for Physical Security report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Sourcing Type

- In-House

- Outsourced

- By Service Type

- Testing

- Inspection

- Certification

- By Industry Vertical

- Access Control

- Video Surveillance

- Intrusion Detection

- Locks, Safes & Vaults

- Door Locking Devices and Hardware

- Ballistic Resistant Materials

- Burglary Resistant Materials

- ATMs

- Anti-Theft Devices

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Sourcing Type

1.2.2. By Service Type

1.2.3. By Industry Vertical

1.2.4. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Sourcing Type

5.1.1. In-House

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Outsourced

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Service Type

5.2.1. Testing

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Inspection

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.2.3. Certification

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2030

5.3. By Industry Vertical

5.3.1. Access Control

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Video Surveillance

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Intrusion Detection

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Locks, Safes & Vaults

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Door Locking Devices and Hardware

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

5.3.6. Ballistic Resistant Materials

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2030

5.3.7. Burglary Resistant Materials

5.3.7.1. Market Definition

5.3.7.2. Market Estimation and Forecast to 2030

5.3.8. ATMs

5.3.8.1. Market Definition

5.3.8.2. Market Estimation and Forecast to 2030

5.3.9. Anti-Theft Devices

5.3.9.1. Market Definition

5.3.9.2. Market Estimation and Forecast to 2030

5.3.10. Others

5.3.10.1. Market Definition

5.3.10.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Sourcing Type

6.2. By Service Type

6.3. By Industry Vertical

6.4. By Country

6.4.1. U.S. Market Estimate and Forecast

6.4.2. Canada Market Estimate and Forecast

6.4.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Sourcing Type

7.2. By Service Type

7.3. By Industry Vertical

7.4. By Country

7.4.1. Germany Market Estimate and Forecast

7.4.2. France Market Estimate and Forecast

7.4.3. U.K. Market Estimate and Forecast

7.4.4. Italy Market Estimate and Forecast

7.4.5. Spain Market Estimate and Forecast

7.4.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Sourcing Type

8.2. By Service Type

8.3. By Industry Vertical

8.4. By Country

8.4.1. China Market Estimate and Forecast

8.4.2. Japan Market Estimate and Forecast

8.4.3. India Market Estimate and Forecast

8.4.4. South Korea Market Estimate and Forecast

8.4.5. Singapore Market Estimate and Forecast

8.4.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Sourcing Type

9.2. By Service Type

9.3. By Industry Vertical

9.4. By Country

9.4.1. Brazil Market Estimate and Forecast

9.4.2. Saudi Arabia Market Estimate and Forecast

9.4.3. South Africa Market Estimate and Forecast

9.4.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Intertek Group plc

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Bureau Veritas

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. UL LLC

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. SGS SA

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Eurofins USA

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. TUV Rheinland

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. DEKRA SE

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Element Materials Technology

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Applus+

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. DNV GL

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to availability of information in secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2023 (USD Billion)

Table 5 Global TIC Market for Physical Security Size, By Sourcing Type, 2025 - 2030 (USD Billion)

Table 6 Global TIC Market for Physical Security Size, By Service Type, 2018 - 2023 (USD Billion)

Table 7 Global TIC Market for Physical Security Size, By Service Type, 2025 - 2030 (USD Billion)

Table 8 Global TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 9 Global TIC Market for Physical Security Size, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 10 Global TIC Market for Physical Security Size, by Region, 2018 - 2023 (USD Billion)

Table 11 Global TIC Market for Physical Security Size, by Region, 2025 - 2030 (USD Billion)

Table 12 North America TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2023 (USD Billion)

Table 13 North America TIC Market for Physical Security Size, By Sourcing Type, 2025 - 2030 (USD Billion)

Table 14 North America TIC Market for Physical Security Size, By Service Type, 2018 - 2023 (USD Billion)

Table 15 North America TIC Market for Physical Security Size, By Service Type, 2025 - 2030 (USD Billion)

Table 16 North America TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 17 North America TIC Market for Physical Security Size, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 18 North America TIC Market for Physical Security Size, by Region, 2018 - 2023 (USD Billion)

Table 19 North America TIC Market for Physical Security Size, by Region, 2025 - 2030 (USD Billion)

Table 20 Europe TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2023 (USD Billion)

Table 21 Europe TIC Market for Physical Security Size, By Sourcing Type, 2025 - 2030 (USD Billion)

Table 22 Europe TIC Market for Physical Security Size, By Service Type, 2018 - 2023 (USD Billion)

Table 23 Europe TIC Market for Physical Security Size, By Service Type, 2025 - 2030 (USD Billion)

Table 24 Europe TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 25 Europe TIC Market for Physical Security Size, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 26 Europe TIC Market for Physical Security Size, by Region, 2018 - 2023 (USD Billion)

Table 27 Europe TIC Market for Physical Security Size, by Region, 2025 - 2030 (USD Billion)

Table 28 Asia-Pacific TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2023 (USD Billion)

Table 29 Asia-Pacific TIC Market for Physical Security Size, By Sourcing Type, 2025 - 2030 (USD Billion)

Table 30 Asia-Pacific TIC Market for Physical Security Size, By Service Type, 2018 - 2023 (USD Billion)

Table 31 Asia-Pacific TIC Market for Physical Security Size, By Service Type, 2025 - 2030 (USD Billion)

Table 32 Asia-Pacific TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 33 Asia-Pacific TIC Market for Physical Security Size, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 34 Asia-Pacific TIC Market for Physical Security Size, by Region, 2018 - 2023 (USD Billion)

Table 35 Asia-Pacific TIC Market for Physical Security Size, by Region, 2025 - 2030 (USD Billion)

Table 36 RoW TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2023 (USD Billion)

Table 37 RoW TIC Market for Physical Security Size, By Sourcing Type, 2025 - 2030 (USD Billion)

Table 38 RoW TIC Market for Physical Security Size, By Service Type, 2018 - 2023 (USD Billion)

Table 39 RoW TIC Market for Physical Security Size, By Service Type, 2025 - 2030 (USD Billion)

Table 40 RoW TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2023 (USD Billion)

Table 41 RoW TIC Market for Physical Security Size, By Industry Vertical, 2025 - 2030 (USD Billion)

Table 42 RoW TIC Market for Physical Security Size, by Region, 2018 - 2023 (USD Billion)

Table 43 RoW TIC Market for Physical Security Size, by Region, 2025 - 2030 (USD Billion)

Table 44 Snapshot – Intertek Group plc

Table 45 Snapshot – Bureau Veritas

Table 46 Snapshot – UL LLC

Table 47 Snapshot – SGS SA

Table 48 Snapshot – Eurofins USA

Table 49 Snapshot – TUV Rheinland

Table 50 Snapshot – DEKRA SE

Table 51 Snapshot – Element Materials Technology

Table 52 Snapshot – Applus+

Table 53 Snapshot – DNV GL

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Methodology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global TIC Market for Physical Security - Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global TIC Market for Physical Security Highlight

Figure 12 Global TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2030 (USD Billion)

Figure 13 Global TIC Market for Physical Security Size, By Service Type, 2018 - 2030 (USD Billion)

Figure 14 Global TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 15 Global TIC Market for Physical Security Size, by Region, 2018 - 2030 (USD Billion)

Figure 16 North America TIC Market for Physical Security Highlight

Figure 17 North America TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2030 (USD Billion)

Figure 18 North America TIC Market for Physical Security Size, By Service Type, 2018 - 2030 (USD Billion)

Figure 19 North America TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 20 North America TIC Market for Physical Security Size, by Region, 2018 - 2030 (USD Billion)

Figure 21 Europe TIC Market for Physical Security Highlight

Figure 22 Europe TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2030 (USD Billion)

Figure 23 Europe TIC Market for Physical Security Size, By Service Type, 2018 - 2030 (USD Billion)

Figure 24 Europe TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 25 Europe TIC Market for Physical Security Size, by Region, 2018 - 2030 (USD Billion)

Figure 26 Asia-Pacific TIC Market for Physical Security Highlight

Figure 27 Asia-Pacific TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2030 (USD Billion)

Figure 28 Asia-Pacific TIC Market for Physical Security Size, By Service Type, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 30 Asia-Pacific TIC Market for Physical Security Size, by Region, 2018 - 2030 (USD Billion)

Figure 31 RoW TIC Market for Physical Security Highlight

Figure 32 RoW TIC Market for Physical Security Size, By Sourcing Type, 2018 - 2030 (USD Billion)

Figure 33 RoW TIC Market for Physical Security Size, By Service Type, 2018 - 2030 (USD Billion)

Figure 34 RoW TIC Market for Physical Security Size, By Industry Vertical, 2018 - 2030 (USD Billion)

Figure 35 RoW TIC Market for Physical Security Size, by Region, 2018 - 2030 (USD Billion)

Global TIC Market for Physical Security- Market Coverage

Sourcing Type Insight and Forecast 2025-2030

- In-House

- Outsourced

Service Type Insight and Forecast 2025-2030

- Testing

- Inspection

- Certification

Industry Vertical Insight and Forecast 2025-2030

- Access Control

- Video Surveillance

- Intrusion Detection

- Locks, Safes & Vaults

- Door Locking Devices and Hardware

- Ballistic Resistant Materials

- Burglary Resistant Materials

- ATMs

- Anti-Theft Devices

- Others

Geographical Segmentation

TIC Market for Physical Security by Region

North America

- By Sourcing Type

- By Service Type

- By Industry Vertical

- By Country – U.S., Canada, and Mexico

Europe

- By Sourcing Type

- By Service Type

- By Industry Vertical

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Sourcing Type

- By Service Type

- By Industry Vertical

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Sourcing Type

- By Service Type

- By Industry Vertical

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Intertek Group plc

- Bureau Veritas

- UL LLC

- SGS SA

- Eurofins USA

- TUV Rheinland

- DEKRA SE

- Element Materials Technology

- Applus+

- DNV GL

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

TIC Market for Physical Security