Industry Overview

The Railway Testing, Inspection, And Certification (TIC) Market reached USD 6.5 billion in 2030, currently, the market in the year 2023 was 2.4 billion, with a projected compound annual growth rate (CAGR) of 2.6% from 2025 to 2030. TIC testing ensures that products, components, and systems meet the intended purpose.

Inspection and testing are the operating parts of quality control, which is the most critical factor for the survival of any manufacturing company. Quality control directly supports other factors such as cost, productivity, on-time delivery, and market share. The testing, inspection, and certification market report is composed of conformity assessment agencies, which provide services from audit and inspection to testing, verification, quality assurance, and certification.

Rail is one of the important transport solutions owing to urbanization and pollution. Globalization has led to product standardization norms and has penetrated developed technologies across various industries such as building & construction, railway, electronics and automotive industries, etc., resulting in the growth of the TIC market during the forecast period 2025-2030. The rail project is complex and has to meet rigorous complex standards. Moreover, rapid urbanization, mandatory safety regulations, upsurge in the illicit trade of counterfeit and pirated products, advancement in networking and communication technology, the inclination of outsourcing testing, inspection, and certification services has propelled the growth of the TIC market in railway industry. Nevertheless, TIC provides various advantages related to its credibility and image, compliance with legal and regulatory requirements, less turnover of employees, high level of cost control improvement, and fast improvement of different processes. The railway industry requires TIC to optimize the cost of the asset, minimize the downtime throughout the lifecycle, and have access to new rail projects. The railway standards consist of EN50126, EN50128, and EN50129 which have been made by European Committee for Electro-Technical Standardization). These standards are for heavy rails systems, light rail, and urban mass transportation.

TIC Market for Railway Industry Segmentation

Insight by Sourcing Type

Based on sourcing type, the TIC market for the railway industry is bifurcated into in-house and outsourced. Among the two segments, the in-house segment dominates the market and is anticipated to hold the largest share during the forecast period 2025-2030. Deploying in-house testing and inspection will offer companies to have complete control over the entire process in terms of technology, skilled personnel, and testing and measurement equipment. Moreover, it can also help manufacturers in reducing in-house compliance costs and easily respond to global market demands.

Insight by Service Type

Based on service type, the TIC market for the railway industry is segmented into testing, inspection, and certification. Among these segments, the testing segment holds the largest share in the testing, inspection, and certification market in 2022 owing to the diverse product standards, stringent regulations, increasing need for improved safety, growing industrialization, and a need to protect the brand. Thus, companies from different industries are increasing their operational expenditure on the investment of testing equipment which offers market growth in the TIC market.

Insight by Industry Vertical

Based on industry vertical, the TIC market for the railway industry is divided into oil condition monitoring, fuel testing, materials testing & analysis, battery testing, product endurance & performance testing, EMC, accelerated stress testing, engine component and durability testing, lubricant and fuel system testing, railway stray current management, crude oil rail car service, and others. In order to electrify railways, there is a need to manage stray current leakage to order to ensure asset integrity and for public safety issues. This issue involves a lot of time and money annually and is linked to electromagnetic compatibility (EMC) issues, corrosion of railways, and electric safety of systems. ADAS and full self-driving solutions are used in light rail and shunting operations. The decarbonization solution will replace diesel trains with battery technology, hydrogen fuel cells, electric trains, resulting in testing of batteries, thus growth of TIC market in railway industry.

Global TIC Market for Railway Industry Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2018 - 2023

|

|

Base Year Considered

|

2024

|

|

Forecast Period

|

2025 - 2030

|

|

Market Size in 2024

|

U.S.D. 2.4 Billion

|

|

Revenue Forecast in 2030

|

U.S.D. 6.5 Billion

|

|

Growth Rate

|

2.6%

|

|

Segments Covered in the Report

|

By Sourcing Type, By Service Type, and By Industry Vertical

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

TIC Market for Railway Industry Trends

The TIC market for railway industry is characterized by various industry trends such as growing investment in AR and VR, smart sensors for inspecting railway tracks, digital communication platforms, automatic train control, mounting adoption of connected devices and cloud-based technology, and sustained consolidation of suppliers leading to globalization.

TIC Market for Railway Industry Growth Drivers

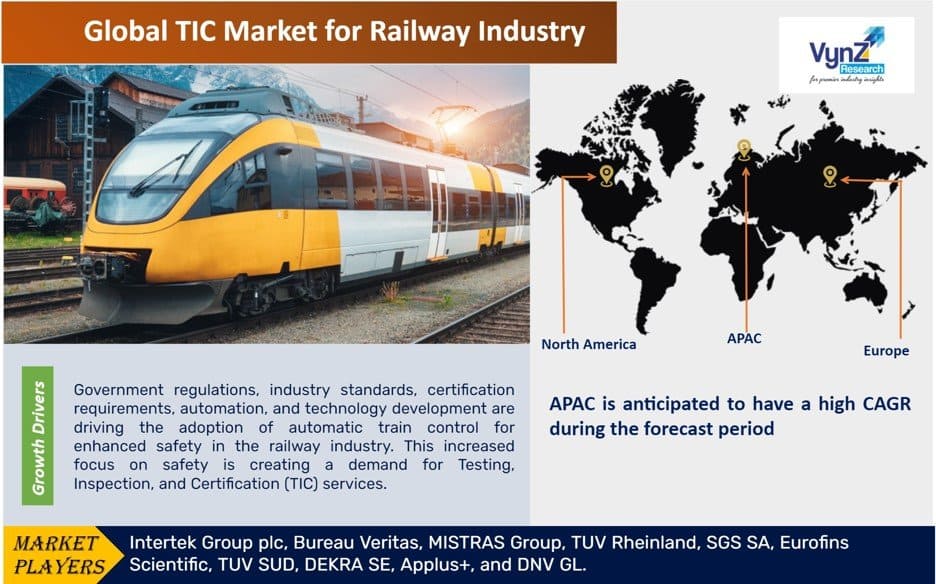

Government regulations, industry standards, certification requirements, automation, and technology development are driving the adoption of automatic train control for enhanced safety in the railway industry. This increased focus on safety is creating a demand for Testing, Inspection, and Certification (TIC) services. Additionally, manufacturing companies are placing more emphasis on delivering high-quality products to improve customer retention. This has led to a growing demand for interoperability testing of connected devices and the Internet of Things (IoT) to enable predictive maintenance and anomaly monitoring. The TIC market in the railway industry is further fueled by globalization, the expansion of global trade, and the emergence of digital technologies.

TIC Market for Railway Industry Challenges

The testing, inspection, and certification market face certain challenges like trade wars and growth fluctuations, huge investment for automation and installation of industrial safety systems, high cost of TIC owing to diverse standards and regulations globally. Moreover, a lack of testing facilities and skilled personnel may hamper the growth of the TIC market in the mining industry.

TIC Market for Railway Industry Opportunities

Testing, inspection, and certification is a massive market that provides lucrative opportunities in technologies such as AI, robotics, drones, big data analytics, next-generation automation, and cloud and cybersecurity. Moreover, rolling stock hybridization and high-speed rail will create opportunities for the growth of TIC in the railway industry.

TIC Market for Railway Industry Geographic Overview

Geographically, APAC is anticipated to have a high CAGR during the forecast period owing to the rising investment in R&D, rapid urbanization & industrialization, huge manufacturing capabilities and exports, demand for safety and product quality, and increasing consumer awareness about the importance of quality certification, testing, and inspection.

TIC Market for Railway Industry Competitive Insight

Key players are adopting technological changes to improve their product portfolio and generate new revenues, optimize the operational cost, and enhance service efficiencies via process upgrades. The industry players are taking the COVID-19 crisis as an opportunity to restructure and revisit their existing strategies, focus on new services and delivery models to access the growing demand for automation, remote service execution, and improved digitization.

The business enterprises have started opening development centers in new locations to enhance market penetration which helps in building business relations with customers and clients. Moreover, the industry players in the TIC market have started building strategies like mergers and acquisitions to generate new revenue channels.

Intertek offer tailored quality assurance solutions across many aspects of the rail and light rail industries that enable to identify and mitigate risk in your operations whilst meeting safety, sustainability and performance standards. Company services include crude oil rail car inspection and testing, non-destructive testing, metallurgy consultancy, non-destructive testing, corrosion and failure analysis, rail car integrity programmes etc.

Bureau Veritas (A global leader in the sector) rail auditing and certification services enable to meet the highest quality, health and safety, environmental protection and social responsibility standards.

Some of the key players operating in the TIC market in the railway industry are Intertek Group plc, Bureau Veritas, MISTRAS Group, TUV Rheinland, SGS SA, Eurofins Scientific, TUV SUD, DEKRA SE, Applus+, and DNV GL.

Recent Developments by Key Players

With a centre of excellence based in Madrid, SGS is accredited by ENAC, the Spanish accreditation entity, as a Notified Body (NoBo), Designated Body (DeBo) and Safety Assessment Body (ISA/AsBo) for all railway subsystems.

Alstom appointed Dekra, a testing inspection and certification company, as a test leader to complete the testing of its hydrogen fuel train in the Northern Netherlands. These strategic initiatives will boost the growth opportunities of companies operating in the market.

Applus and Euskontrol, S.A had a joint venture which has been contracted by ADIF Alta Velocidad, the state-owned company responsible for Spain’s high-speed rail infrastructure, to carry out comparative testing on railway platform works on the high-speed Vitoria–Bilbao–San Sebastián line.

The TIC Market for Railway Industry report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Sourcing Type

- By Service Type

- Testing

- Inspection

- Certification

- By Industry Vertical

- Oil Condition Monitoring

- Fuel Testing, Materials Testing & Analysis

- Battery Testing

- Product Endurance & Performance Testing

- EMC

- Accelerated Stress Testing

- Engine Component and Durability Testing

- Lubricant and Fuel System Testing

- Railway Stray Current Management

- Crude Oil Rail Car Service

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)