- 1-888-253-3960

- enquiry@vynzresearch.com

-

This is lorem ipsum doller

Wireless Power Transmission Market

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9099 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 250 |

Global Wireless Power Transmission Market – Analysis and Forecast (2025-2030)

Industry Insight by Technology (Near-Field Technology (Inductive, Magnetic Resonance, and Capacitive Coupling/Conductive) and Far-Field Technology (Microwave/RF And Laser/Infrared), by Type (Device with Battery and Device without Battery), by Receiver Application (Smartphones, Tablets, Wearable Electronics, Notebooks, Other Consumer Electronics, Electric Vehicle Charging, and Industrial), by Transmitter Application (Standalone Chargers, Automotive (In-Vehicle), Electric Vehicle Charging, Furniture, and Industrial), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industry Overview

The Global Wireless Power Transmission Market is projected to experience significant growth in the coming years, with an estimated value of USD 18 billion by 2030. From 2025 to 2030, it is expected to witness a robust compound annual growth rate (CAGR) of 22.5%. Wireless power transmission, also known as WPT, refers to the process of transmitting electrical energy without the need for cables. It relies on the utilization of transmitter and receiver coils, along with technologies such as microwaves, solar cells, and magnetic resonance.

Numerous devices benefit from wireless power transmission, including mobile phones, tablets, automobiles, drones, transportation equipment, and even solar-panel arrays in space, enabling efficient recharging. This technology brings about improvements in reliability, portability, and convenience while eliminating the constraints of wires and batteries. As a result, it finds extensive applications across various industries, including consumer electronics, automotive, robotics, heating and ventilation, and industrial engineering.

Several key factors drive the growth of the wireless power transmission market. One significant factor is the increasing demand for the upgradation of existing infrastructure with advanced systems. Additionally, there is a mounting global need for stable and safe power supply, further fueling the expansion of this market. These factors combined create a favorable environment for the growth and adoption of wireless power transmission technologies.

The COVD-19 pandemic has had an adverse impact on the wireless power transmission market owing to a halt in electronics and semiconductor production facilities and a lack of labor force globally. Furthermore, the decline in manufacturing utilization, temporary facility closures, and travel bans have led to a decline in the growth of the wireless power transmission market in 2020. However, the wireless power transmission market is anticipated to recover from the crisis and there will be massive demand for wireless power transmission products post-pandemic period.

Wireless Power Transmission Market Segmentation

Insight by Technology

The global wireless power transmission market is divided into two categories based on technology: near-field technology and far-field technology. The near-field technology is sub-divided into inductive, magnetic resonance, and capacitive coupling/conductive. The far-field technology is sub-divided into microwave/RF and laser/infrared. Near-field technology dominates the market. Most applications that require contact or close proximity of around a few centimeters between the power source and its destination are served by near-field technologies with a limited range. Inductive technology in the near-field technology contributes to the largest share in the wireless power transmission market owing to its increased adoption in smartphones, tablets, and wearable devices as it is reliable, less costly, and has ease in availability.

Insight by Type

Based on type, the global wireless power transmission market is bifurcated into device with battery and device without battery. The device with a battery is anticipated to have a significant growth owing to its convenience, mobility, and safety of a device and radiation can travel long distances.

Insight by Receiver Application

Based on receiver application, the global wireless power transmission market is divided into smartphones, tablets, wearable electronics, notebooks, other consumer electronics, electric vehicle charging, and industrial. Smartphones dominate the receiver application for the wireless power transmission market as it uses inductive wireless power transmission. Some of the wireless charging smartphones include Samsung Galaxy Series, Motorola Droid phones, and Google Nexus phones, among others.

Insight by Transmitter Application

Based on transmitter application, the global wireless power transmission market is divided into standalone chargers, automotive (in-vehicle), electric vehicle charging, furniture, and industrial. Electric vehicle charging is expected to be the fastest-growing transmitter application as wireless charging is the optimal solution to charge electric vehicles and hybrid electric vehicles. Businesses are offering complete wireless charging options for electric vehicles which is possible via inductive technology.

Global Wireless Power Transmission Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 - 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2024 |

U.S.D. 6.5 Billion |

|

Revenue Forecast in 2030 |

U.S.D. 18 Billion |

|

Growth Rate |

22.5% |

|

Segments Covered in the Report |

By Technology, By Type, By Receiver Application, and By Transmitter Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Wireless Power Transmission Industry Trends

The rising trend of industrialization increased penetration of IoT, and growth in digitalization are the trends prevalent in the wireless power transmission market. Furthermore, the shifting trend towards the increased standard of living and rising disposable income will further accelerate the growth of the global wireless power transmission market.

Wireless Power Transmission Market Growth Drivers

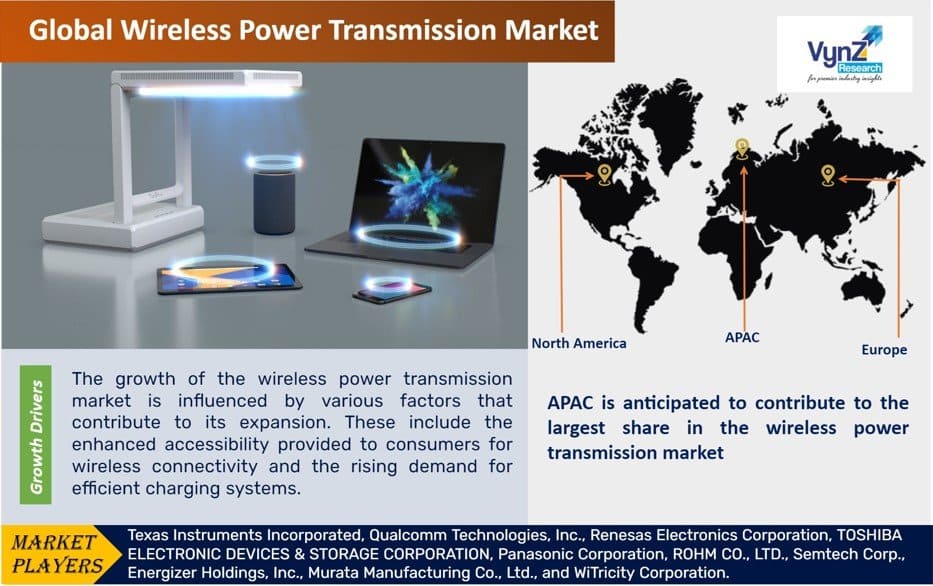

The growth of the wireless power transmission market is influenced by various factors that contribute to its expansion. These include the enhanced accessibility provided to consumers for wireless connectivity and the rising demand for efficient charging systems. Wireless power devices' ability to transmit power through strong electromagnetic fields, along with the limitations of wired power transmission, is expected to positively impact market growth.

The wireless power transmission technology market is poised for growth due to several driving forces. These include rapid industrialization, increasing awareness of clean energy storage, the ongoing modernization and construction of smart cities, surging demand for consumer electronics, rising utilization of robots and drones, continuous technological advancements, and the need to establish connectivity in remote areas.

Furthermore, the wireless power transmission market will benefit from the advantages it offers to end-users, such as extended battery life and reduced energy consumption.

Wireless Power Transmission Market Challenges

The massive cost deployed for wireless power transmission technology-based devices as compared to conventional transmission sources, lack of the availability of brands that can assure quality, and uncertified and non-standardized products will affect the user experience which may restrain the growth of the market. Furthermore, limitation of range, safety issue, dearth of knowledge, lack of infrastructure, and technological expertise along with technological challenges occurring during service of island-style may pose a challenge in the WPT market.

Wireless Power Transmission Market Opportunities

The use of solar energy in wireless power transmission, as well as firms such as Nissan, Honda, and others focusing on electric vehicles, will generate the potential for growth in the WPT market between 2021 and 2027. Furthermore, the increased expenditure of R&D activities on mini and microrobots for wireless power transfer and the adoption of clean energy capacities in Asia-Pacific countries will further provide opportunities for growth in the market.

Wireless Power Transmission Market Geographic Overview

Geographically, APAC is anticipated to contribute to the largest share in the wireless power transmission market during the projected period as it is the manufacturing hub for consumer electronic products like smartphones, tablets, wearable devices, laptops, etc. Moreover, the increased R&D activities, developments in the automobile industry in China, Malaysia, and Indonesia, favorable regulations, and incentives by the government to enhance renewable energy and availability of raw materials will accelerate the growth of the market in the region.

Wireless Power Transmission Market Competitive Insight

The industry players are entering into organic and inorganic strategies such as product portfolio expansion, geographical expansion, M&A, partnerships, agreements, collaborations to enhance their market penetration and strengthen their position in the market. The small players are entering the wireless power transmission market by forming strategic alliances will global industry players like Qualcomm Technologies, Texas Instruments, Inc., SAMSUNG, and Murata Manufacturing Co., Ltd.

One of the most well-known semiconductor firms, Texas Instruments, Inc., provides a component supplier list for wireless power transfer technology. The company offers a wide range of wireless power transmitter and receiver ICs and modules, with power requirements ranging from low to high. The company is improving connectivity protocols such as Wi-Fi, Bluetooth, Sub-1 GHz, Zigbee, etc. They also provide a portfolio of low-cost, high-quality wireless microcontrollers (MCUs), certified modules, and transceivers, as well as complete software solutions to meet every RF design requirement. Wearables, smartphones, automotive, grid infrastructure, factory automation, industrial, and medical care are among the applications that the company is working on.

For wireless charger applications, Renesas is a leader in wireless power transmitter IC solutions. Renesas enables OEMs and ODMs to design charging bases that are fully compatible with any Qi-compliant portable device by providing Qi-compliant support for multiple input voltages and coil configurations. Renesas wireless power transmitter solutions are suited for charging mats and pads, public facilities, office furniture, personal computer docks, and other portable electronic charging systems. It is a market leader for mobile devices and transmitters in the smartphone sector. Renesas delivers a Qi 1.3 compatible automobile in-cabin wireless power system that also supports functional safety.

Some of the industry players in the wireless power transmission market include Texas Instruments Incorporated, Qualcomm Technologies, Inc., Renesas Electronics Corporation, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Panasonic Corporation, ROHM CO., LTD., Semtech Corp., Energizer Holdings, Inc., Murata Manufacturing Co., Ltd., and WiTricity Corporation.

Recent Developments by Key Players

Renesas Electronics Corporation, a leading provider of advanced semiconductor solutions has announced the P9418 which is the world's first 60W wireless power receiver so as to provide faster wireless charging solutions in smartphones, laptops, and notebook devices. The highly integrated P9418 wireless power receiver uses Renesas' patented WattShare technology to supply up to 60W of power in a single chip.

Panasonic Corporation has designed a secure near-field communication technology based on Wavelet OFDM*2 and a magnetic field communication mechanism. As a result, the communication range can be limited to a few millimeters to tens of centimeters. By adjusting the size of the loop antenna and the communication device's transmission power, this technique can simply manage the communication range.

The Wireless Power Transmission Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Technology

- Near-Field Technology

- Inductive

- Magnetic Resonance

- Capacitive Coupling/Conductive

- Far-Field Technology

- Microwave/RF

- Laser/Infrared

- Near-Field Technology

- By Type

- Device with Battery

- Device without Battery

- By Receiver Application

- Smartphones

- Tablets

- Wearable Electronics

- Notebooks

- Other Consumer Electronics

- Electric Vehicle Charging

- Industrial

- By Transmitter Application

- Standalone Chargers

- Automotive (In-Vehicle)

- Electric Vehicle Charging

- Furniture

- Industrial

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By Technology

1.2.2. By Type

1.2.3. By Receiver Application

1.2.4. By Transmitter Application

1.2.5. By Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1. Primary Research

1.5.1.2. Secondary Research

1.5.2. Methodology

1.5.2.1. Data Exploration

1.5.2.2. Forecast Parameters

1.5.2.3. Data Validation

1.5.2.4. Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2030

5. Market Segmentation Estimate and Forecast

5.1. By Technology

5.1.1. Near-Field Technology

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2030

5.1.2. Far-Field Technology

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2030

5.2. By Type

5.2.1. Device with Battery

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2030

5.2.2. Device without Battery

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2030

5.3. By Receiver Application

5.3.1. Smartphones

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Tablets

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Wearable Electronics

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.4. Notebooks

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Other Consumer Electronics

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

5.3.6. Electric Vehicle Charging

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2030

5.3.7. Industrial

5.3.7.1. Market Definition

5.3.7.2. Market Estimation and Forecast to 2030

5.3. By Transmitter Application

5.3.1. Standalone Chargers

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2030

5.3.2. Automotive (In-Vehicle)

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2030

5.3.3. Electric Vehicle Charging

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2030

5.3.4. Furniture

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2030

5.3.5. Industrial

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2030

6. North America Market Estimate and Forecast

6.1. By Technology

6.2. By Type

6.3. By Receiver Application

6.5. By Transmitter Application

6.6 By Country – U.S., Canada, and Mexico

6.5.1. U.S. Market Estimate and Forecast

6.5.2. Canada Market Estimate and Forecast

6.5.3. Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By Technology

7.2. By Type

7.3. By Receiver Application

7.5. By Transmitter Application

7.6 By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

7.5.1. Germany Market Estimate and Forecast

7.5.2. France Market Estimate and Forecast

7.5.3. U.K. Market Estimate and Forecast

7.5.4. Italy Market Estimate and Forecast

7.5.5. Spain Market Estimate and Forecast

7.5.6. Rest of Europe Market Estimate and Forecast

8. Asia-Pacific Market Estimate and Forecast

8.1. By Technology

8.2. By Type

8.3. By Receiver Application

8.5. By Transmitter Application

8.6 By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

8.5.1. China Market Estimate and Forecast

8.5.2. Japan Market Estimate and Forecast

8.5.3. India Market Estimate and Forecast

8.5.4. South Korea Market Estimate and Forecast

8.5.5. Singapore Market Estimate and Forecast

8.5.6. Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By Technology

9.2. By Type

9.3. By Receiver Application

9.5. By Transmitter Application

9.6 By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

9.5.1. Brazil Market Estimate and Forecast

9.5.2. Saudi Arabia Market Estimate and Forecast

9.5.3. South Africa Market Estimate and Forecast

9.5.4. Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Texas Instruments Incorporated

10.1.1. Snapshot

10.1.2. Overview

10.1.3. Offerings

10.1.4. Financial Insight

10.1.5. Recent Developments

10.2. Qualcomm Technologies, Inc.

10.2.1. Snapshot

10.2.2. Overview

10.2.3. Offerings

10.2.4. Financial Insight

10.2.5. Recent Developments

10.3. Renesas Electronics Corporation

10.3.1. Snapshot

10.3.2. Overview

10.3.3. Offerings

10.3.4. Financial Insight

10.3.5. Recent Developments

10.4. TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

10.4.1. Snapshot

10.4.2. Overview

10.4.3. Offerings

10.4.4. Financial Insight

10.4.5. Recent Developments

10.5. Panasonic Corporation

10.5.1. Snapshot

10.5.2. Overview

10.5.3. Offerings

10.5.4. Financial Insight

10.5.5. Recent Developments

10.6. ROHM CO., LTD.

10.6.1. Snapshot

10.6.2. Overview

10.6.3. Offerings

10.6.4. Financial Insight

10.6.5. Recent Developments

10.7. Semtech Corp.

10.7.1. Snapshot

10.7.2. Overview

10.7.3. Offerings

10.7.4. Financial Insight

10.7.5. Recent Developments

10.8. Energizer Holdings, Inc.

10.8.1. Snapshot

10.8.2. Overview

10.8.3. Offerings

10.8.4. Financial Insight

10.8.5. Recent Developments

10.9. Murata Manufacturing Co., Ltd.

10.9.1. Snapshot

10.9.2. Overview

10.9.3. Offerings

10.9.4. Financial Insight

10.9.5. Recent Developments

10.10. WiTricity Corporation

10.10.1. Snapshot

10.10.2. Overview

10.10.3. Offerings

10.10.4. Financial Insight

10.10.5. Recent Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

List of Tables

Table 1 Sources

Table 2 Study Periods

Table 3 Data Reporting Unit

Table 4 Global Wireless Power Transmission Market, By Technology, 2018 - 2023 (USD Billion)

Table 5 Global Wireless Power Transmission Market, By Technology, 2025 - 2030 (USD Billion)

Table 6 Global Wireless Power Transmission Market, By Type, 2018 - 2023 (USD Billion)

Table 7 Global Wireless Power Transmission Market, By Type, 2025 - 2030 (USD Billion)

Table 8 Global Wireless Power Transmission Market, By Receiver Application, 2018 - 2023 (USD Billion)

Table 9 Global Wireless Power Transmission Market, By Receiver Application, 2025 - 2030 (USD Billion)

Table 10 Global Wireless Power Transmission Market, By Transmitter Application, 2018 - 2023 (USD Billion)

Table 11 Global Wireless Power Transmission Market, By Transmitter Application, 2025 - 2030 (USD Billion)

Table 12 Global Wireless Power Transmission Market, By Region, 2018 - 2023 (USD Billion)

Table 13 Global Wireless Power Transmission Market, By Region, 2025 - 2030 (USD Billion)

Table 14 North America Wireless Power Transmission Market, By Technology, 2018 - 2023 (USD Billion)

Table 15 North America Wireless Power Transmission Market, By Technology, 2025 - 2030 (USD Billion)

Table 16 North America Wireless Power Transmission Market, By Type, 2018 - 2023 (USD Billion)

Table 17 North America Wireless Power Transmission Market, By Type, 2025 - 2030 (USD Billion)

Table 18 North America Wireless Power Transmission Market, By Receiver Application, 2018 - 2023 (USD Billion)

Table 19 North America Wireless Power Transmission Market, By Receiver Application, 2025 - 2030 (USD Billion)

Table 20 North America Wireless Power Transmission Market, By Transmitter Application, 2018 - 2023 (USD Billion)

Table 21 North America Wireless Power Transmission Market, By Transmitter Application, 2025 - 2030 (USD Billion)

Table 22 North America Wireless Power Transmission Market, By Region, 2018 - 2023 (USD Billion)

Table 23 North America Wireless Power Transmission Market, By Region, 2025 - 2030 (USD Billion)

Table 24 Europe Wireless Power Transmission Market, By Technology, 2018 - 2023 (USD Billion)

Table 25 Europe Wireless Power Transmission Market, By Technology, 2025 - 2030 (USD Billion)

Table 26 Europe Wireless Power Transmission Market, By Type, 2018 - 2023 (USD Billion)

Table 27 Europe Wireless Power Transmission Market, By Type, 2025 - 2030 (USD Billion)

Table 28 Europe Wireless Power Transmission Market, By Receiver Application, 2018 - 2023 (USD Billion)

Table 29 Europe Wireless Power Transmission Market, By Receiver Application, 2025 - 2030 (USD Billion)

Table 30 Europe Wireless Power Transmission Market, By Transmitter Application, 2018 - 2023 (USD Billion)

Table 31 Europe Wireless Power Transmission Market, By Transmitter Application, 2025 - 2030 (USD Billion)

Table 32 Europe Wireless Power Transmission Market, By Region, 2018 - 2023 (USD Billion)

Table 33 Europe Wireless Power Transmission Market, By Region, 2025 - 2030 (USD Billion)

Table 34 Asia-Pacific Wireless Power Transmission Market, By Technology, 2018 - 2023 (USD Billion)

Table 35 Asia-Pacific Wireless Power Transmission Market, By Technology, 2025 - 2030 (USD Billion)

Table 36 Asia-Pacific Wireless Power Transmission Market, By Type, 2018 - 2023 (USD Billion)

Table 37 Asia-Pacific Wireless Power Transmission Market, By Type, 2025 - 2030 (USD Billion)

Table 38 Asia-Pacific Wireless Power Transmission Market, By Receiver Application, 2018 - 2023 (USD Billion)

Table 39 Asia-Pacific Wireless Power Transmission Market, By Receiver Application, 2025 - 2030 (USD Billion)

Table 40 Asia-Pacific Wireless Power Transmission Market, By Transmitter Application, 2018 - 2023 (USD Billion)

Table 41 Asia-Pacific Wireless Power Transmission Market, By Transmitter Application, 2025 - 2030 (USD Billion)

Table 42 Asia-Pacific Wireless Power Transmission Market, By Region, 2018 - 2023 (USD Billion)

Table 43 Asia-Pacific Wireless Power Transmission Market, By Region, 2025 - 2030 (USD Billion)

Table 44 RoW Wireless Power Transmission Market, By Technology, 2018 - 2023 (USD Billion)

Table 45 RoW Wireless Power Transmission Market, By Technology, 2025 - 2030 (USD Billion)

Table 46 RoW Wireless Power Transmission Market, By Type, 2018 - 2023 (USD Billion)

Table 47 RoW Wireless Power Transmission Market, By Type, 2025 - 2030 (USD Billion)

Table 48 RoW Wireless Power Transmission Market, By Receiver Application, 2018 - 2023 (USD Billion)

Table 49 RoW Wireless Power Transmission Market, By Receiver Application, 2025 - 2030 (USD Billion)

Table 50 RoW Wireless Power Transmission Market, By Transmitter Application, 2018 - 2023 (USD Billion)

Table 51 RoW Wireless Power Transmission Market, By Transmitter Application, 2025 - 2030 (USD Billion)

Table 52 RoW Wireless Power Transmission Market, By Region, 2018 - 2023 (USD Billion)

Table 53 RoW Wireless Power Transmission Market, By Region, 2025 - 2030 (USD Billion)

Table 54 Snapshot – GE Healthcare

Table 55 Snapshot – Perkinelmer Inc.

Table 56 Snapshot – Koninklijke N.V.

Table 57 Snapshot – Qiagen

Table 58 Snapshot – Pacific Biosciences of California Inc.

Table 59 Snapshot – Agilent Technologies Inc.

Table 60 Snapshot – Beijing Genomics Institute

List of Figures

Figure 1 Market Coverage

Figure 2 Research Phases

Figure 3 Secondary Sources for Different Parameters

Figure 4 Typeology

Figure 5 Data Mining & Exploration

Figure 6 Data Triangulation

Figure 7 Assumptions for Market Estimation and Forecast

Figure 8 Market Synopsis

Figure 9 Global Wireless Power Transmission Market- Growth Drivers and Restraints

Figure 10 Competitive Benchmark

Figure 11 Global Wireless Power Transmission Market Highlight

Figure 12 Global Wireless Power Transmission Market, By Technology, 2018 - 2030 (USD Billion)

Figure 13 Global Wireless Power Transmission Market, By Type, 2018 - 2030 (USD Billion)

Figure 13 Global Wireless Power Transmission Market, By Receiver Application, 2018 - 2030 (USD Billion)

Figure 14 Global Wireless Power Transmission Market, By Transmitter Application, 2018 - 2030 (USD Billion)

Figure 15 Global Wireless Power Transmission Market, By Region, 2018 - 2030 (USD Billion)

Figure 16 North America Wireless Power Transmission Market Highlight

Figure 17 North America Wireless Power Transmission Market, By Technology, 2018 - 2030 (USD Billion)

Figure 18 North America Wireless Power Transmission Market, By Type, 2018 - 2030 (USD Billion)

Figure 18 North America Wireless Power Transmission Market, By Receiver Application, 2018 - 2030 (USD Billion)

Figure 19 North America Wireless Power Transmission Market, By Transmitter Application, 2018 - 2030 (USD Billion)

Figure 20 North America Wireless Power Transmission Market, by Region, 2018 - 2030 (USD Billion)

Figure 21 Europe Wireless Power Transmission Market Highlight

Figure 22 Europe Wireless Power Transmission Market, By Technology, 2018 - 2030 (USD Billion)

Figure 23 Europe Wireless Power Transmission Market, By Type, 2018 - 2030 (USD Billion)

Figure 23 Europe Wireless Power Transmission Market, By Receiver Application, 2018 - 2030 (USD Billion)

Figure 24 Europe Wireless Power Transmission Market, By Transmitter Application, 2018 - 2030 (USD Billion)

Figure 25 Europe Wireless Power Transmission Market, by Region, 2018 - 2030 (USD Billion)

Figure 26 Asia-Pacific Wireless Power Transmission Market Highlight

Figure 27 Asia-Pacific Wireless Power Transmission Market, By Technology, 2018 - 2030 (USD Billion)

Figure 28 Asia-Pacific Wireless Power Transmission Market, By Type, 2018 - 2030 (USD Billion)

Figure 28 Asia-Pacific Wireless Power Transmission Market, By Receiver Application, 2018 - 2030 (USD Billion)

Figure 29 Asia-Pacific Wireless Power Transmission Market, By Transmitter Application, 2018 - 2030 (USD Billion)

Figure 30 Asia-Pacific Wireless Power Transmission Market, by Region, 2018 - 2030 (USD Billion)

Figure 31 RoW Wireless Power Transmission Market Highlight

Figure 32 RoW Wireless Power Transmission Market, By Technology, 2018 - 2030 (USD Billion)

Figure 33 RoW Wireless Power Transmission Market, By Type, 2018 - 2030 (USD Billion)

Figure 33 RoW Wireless Power Transmission Market, By Receiver Application, 2018 - 2030 (USD Billion)

Figure 34 RoW Wireless Power Transmission Market, By Transmitter Application, 2018 - 2030 (USD Billion)

Figure 35 RoW Wireless Power Transmission Market, By Region, 2018 - 2030 (USD Billion)

Global Wireless Power Transmission Market Coverage

Technology Insight and Forecast 2025-2030

- Near-Field Technology

- Inductive

- Magnetic Resonance

- Capacitive Coupling/Conductive

- Far-Field Technology

- Microwave/RF

- Laser/Infrared

Type Insight and Forecast 2025-2030

- Device with Battery

- Device without Battery

Receiver Application Insight and Forecast 2025-2030

- Smartphones

- Tablets

- Wearable Electronics

- Notebooks

- Other Consumer Electronics

- Electric Vehicle Charging

- Industrial

Transmitter Application Insight and Forecast 2025-2030

- Standalone Chargers

- Automotive (In-Vehicle)

- Electric Vehicle Charging

- Furniture

- Industrial

Geographical Segmentation

Wireless Power Transmission Market by Region

North America

- By Technology

- By Type

- By Receiver Application

- By Transmitter Application

- By Country – U.S., Canada, and Mexico

Europe

- By Technology

- By Type

- By Receiver Application

- By Transmitter Application

- By Country – Germany, U.K., France, Italy, Spain, Russia, and Rest of Europe

Asia-Pacific (APAC)

- By Technology

- By Type

- By Receiver Application

- By Transmitter Application

- By Country – China, Japan, India, South Korea, and Rest of Asia-Pacific

Rest of the World (RoW)

- By Technology

- By Type

- By Receiver Application

- By Transmitter Application

- By Country – Brazil, Saudi Arabia, South Africa, U.A.E., and Other Countries

Vynz Research know in your business needs, you required specific answers pertaining to the market, Hence, our experts and analyst can provide you the customized research support on your specific needs.

After the purchase of current report, you can claim certain degree of free customization within the scope of the research.

Please let us know, how we can serve you better with your specific requirements to your research needs. Vynz research promises for quick reversal for your current business requirements.

- Texas Instruments Incorporated

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Panasonic Corporation

- ROHM CO. LTD.

- Semtech Corp.

- Energizer Holdings Inc.

- Murata Manufacturing Co. Ltd.

- WiTricity Corporation

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Wireless Power Transmission Market